When the B20 Token Project was launched, anchored on Beeple’s artworks, it immediately resonated with the NFT Community. After all, it promised ordinary NFT enthusiasts who could never afford a Beeple NFT a chance to own a piece of the upside of the NFT Art Revolution through fractional NFTs. If you are bullish on NFTs, how can you pass up such a chance?

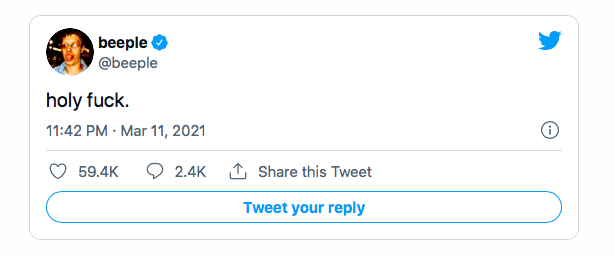

B20 token was trading at about $2 a token back in Mid February. Then, the price action skyrocketed when the hammer went down, marking the sale of Beeple’s Everydays: The First 5000 Days for $69.3 Million. The token recorded an all-time high price of $28. Based on CoinMarketCap, today’s rate is $1.41. Moreover, prices have stayed in the one-dollar range since Mid May despite the overall rally in the NFT space.

Naturally, toke holders are starting to ask questions. Is Beeple’s token price really worth nothing now? Is the future bleak, as the chart implies?

B20 Tokens

Before we jump into the arguments and analysis, let’s run down the facts first.

Metapurse is a crypto-exclusive fund that specializes in identifying early-stage projects and investing in blue-chip digital art pieces. In December, it bought a suite of 20 Beeple NFTs collectively valued at around $2.2 Million. The fund is also the buyer of Beeple’s $69.3 Million Artwork.

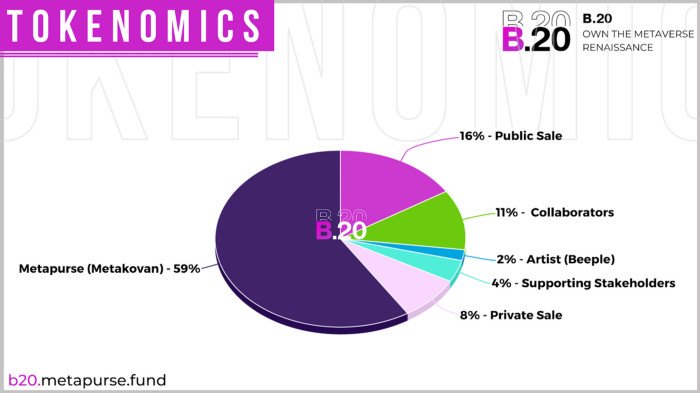

Metapurse shared ownership of its $2.2 Million Beeple Art Collection and the virtual museums where they show the art through the B20 Token. They organized a public sale of the B20 tokens around January 23. A total of 1.6 Million tokens were sold for $0.36, representing 16% of the token supply.

The total supply of B20 Tokens is 10,000,000. Following the tokenomics released by Metapurse, the project had a value of $2.7 Million. Meanwhile, Metapurse kept 59% of the tokens. Then, 11% went to the collaborators: Metacast, GrowYourBase and Voxel Architects. 8% were sold on a private sale, 4% went to stakeholders and finally, 2% went to Beeple.

Given the distribution, it’s clear that true power lies in the Metapurse Fund. Next question, who are the owners of the fund?

Meet MetaKovan and Twobadour

It turned out that two crypto-preneurs are behind the fund – Vignesh Sundaresan, who goes by MetaKovan and Anand Venkateswaran, also known as Twobadour.

MetaKovan has been in the crypto space since 2013. He said that he lived in Canada for several years and then left for Singapore in 2017 because crypto regulations in North America were too “unclear.”

He claims that he started with zero capital, so he looked to the global and open network of Bitcoin to earn some cash. Eventually, he offered escrow services and set up an exchange in Canada called Coins-e. The turning point of his wealth generation was when he invested in the world’s first Initial Coin Offering (ICO) of Ethereum.

He parlayed his gains to fund multiple projects like Polkadot, Tezos, Dfinity, Decentraland, Flow and others. All of which are now main players in the crypto and NFT space. This is also how he got the funds for Metapurse.

Controversies

Independent blogger Amy Castor suspects that Beeple and MetaKovan are in cahoots to increase the value of the rest of Beeple’s Collection within the B20 project. She made her stance very clear in her article. She explained that the tokenomics awarding 59% to MetaKovan and 2% to Beeple is flawed and represents a conflict of interest.

Looking at facts, the sale of Beeple’s Everydays: The First 5000 Days indeed positively affected the price of B20 Token. To illustrate, the price shot up to $23 right after the auction. This means the sale of Beeple’s latest NFT boosted the value of the entire collection by over 6000%.

Castor also claimed that since she published her article, MetaKovan personally wrote to him and asked her to take it down. She refused but agreed to make edits if he could point out anything specific that was wrong. “So far, he hasn’t,” said Castor.

Metapurse’s Response

So the million-dollar question that the community and token holders are asking now is what’s next for the B.20 Project? Are the B20 tokens a lost case?

On May 4, Twobadour (aka Anand Venkateswaran), one of the figures behind Metapurse, made public the details of the promised next chapter in the B.20 story while being interviewed by crypto enthusiast Alegria on a Twitch stream.

The plan? Metapurse is promising to go forward with a facet of its smart contract, which will allow control of all of B.20’s assets, including the 20 Beeple artworks the fund purchased last December, to be sold with a minimum bid of $58 million.

He is referring to the “buyout option” in the smart contract. According to Metapurse’s Medium post back in January, anyone can try to bid for the entire bundle and buy it out. The smart contract allows for anyone to come in with a minimum bid of somewhere between $12 mn to $15 mn (TBD) and get all of the NFTs.

Twobadour highlighted that the potential “buyout” of B.20 would not be a “yard sale” of the assets. “B.20 is one single idea and therefore one single NFT,” he explained. “What’s going to be auctioned off when the buyout goes live is the master key of the experience—one single NFT. We call it the ‘B.20 master key.’ And only the owner of this B.20 master key has any right over the B.20 experience.”

He went on to boast that if it hit the target price, the “master key” would be “the second most valuable NFT ever.”

The community didn’t really respond well to these pronouncements. It sounded more like a possibility than a plan. Moreover, how can a buyout be possible if MetaKovan holds 69% of the tokens? Doesn’t that make it mathematically impossible for someone to buy out the B.20 Project?

Unfortunately, there are more questions at this point than answers. Cryptocurrencies are notorious for growth and slump in thousands, so in this case, it looks like time will be the ultimate truth-teller.

All investment/financial opinions expressed by NFTevening.com are not recommendations.

This article is educational material.

As always, make your own research prior to making any kind of investment.