So, you are just getting into crypto and investing and now you want to know how to buy an NFT on a marketplace. Well, you can make a lot of money just by investing in NFTs. Whether you like non-fungible art, collectibles or blockchain games, let us take you through everything you should know before signing any transactions on your crypto wallet.

If you’re already lost- don’t panic. Check out our previous guide on what a non-fungible token is and you should be up to speed. Learning to buy NFTs from a marketplace like OpenSea can be incredibly easy once you have the right information. So let us guide you on everything to do with buying NFTs from what you’ll need, to where to buy your first NFT and how.

What Are NFTs?

NFTs are unique digital assets recorded on blockchains like Ethereum. They provide proof of ownership and authenticity for digital items like art, collectibles, music, videos, and more. NFTs are non-fungible, meaning they cannot be exchanged for another identical item.

The ownership and transaction history of NFTs are transparently tracked using blockchain technology. NFTs unlock new creative markets and business models, allowing digital creators to monetize their work. While NFTs boomed in 2021, they continue evolving across industries in 2023 despite market fluctuations. Their unique properties and applicability make NFTs an emerging digital asset class.

Why Do People Invest in NFTs?

From an outsider’s perspective, it is truly baffling why someone would be willing to pay 400 Ether or about $1.3 Million for a photo of an NFT of a rock. However, there are some core aspects of blockchain technology that make NFTs valuable.

- Fractional Ownership of Physical Assets: NFTs enable the easy division of ownership for various assets, like real estate or album rights, providing accessibility to a broader investor base.

- Improved Market Efficiency: NFTs enhance market efficiency by eliminating intermediaries, reducing transaction costs, and enabling direct interactions between creators and consumers, particularly benefiting digital artists.

- Blockchain Security: NFTs leverage blockchain technology, ensuring secure and tamper-proof records. The decentralized nature of blockchain provides a unique record of authenticity and ownership, safeguarding NFTs from theft and ensuring market confidence.

- Diversification in Investment Portfolio: NFTs offer a distinctive risk profile compared to traditional assets like stocks and bonds. Including NFTs in an investment portfolio provides diversification, potentially enhancing the overall risk-to-reward ratio.

- Continuous Royalties for Creators: NFTs allow creators to earn ongoing royalties by setting a percentage for each resale. This provides a steady income stream for artists, incentivizing creativity and long-term engagement with their audience.

Technicalities Of Buying NFTs

Some of the other main reasons people buy NFTs are these:

- Traceability – NFTs allow you to track where each token has been and who has claimed ownership

- Transparency – Everyone on the blockchain can follow the movement of community money

- Profit – While profit isn’t guaranteed, many NFT investors make a huge profit flipping NFTs

- Bragging Rights – Some NFT projects offer exclusive events, merch, or collaborations

- Community – Some NFT projects offer communities including therapy groups, games meetups and more

- Utility – VeeFriends pioneered the utility aspect of NFTs. Today there are projects offering experiences, discounts on brands, limited edition products, and more.

If you’re still unsure as to why NFTs are valuable, make sure to check out our guide on why to buy NFTs in the first place!

What you’ll need to buy an NFT: starting with Crypto

Today, there are several chains that support NFTs. The most popular and the longest-standing is still the Ethereum chain. However, Tezos, Solana, and Cardano NFTs all have their own cult following. As a first step, you’ll need a wallet that can interact with smart contracts. For a full explanation, check out our guide on choosing a crypto wallet for NFTs. If you’re just keeping it simple, let’s stick to the most popular chain for NFTs, using the most popular wallet in the world.

How to set up a wallet for NFTs

MetaMask is arguably the most popular NFT-supporting wallet on the Ethereum network. You can download it as a chrome browser or an app on your phone. They will prompt you to choose a password and create your new Ethereum wallet. Then, they will show you a 12-word phrase. This is your seed phrase – write it down! You’ll need it if you ever get locked out of your wallet.

How To Get ETH into your wallet

If you want to invest in an Ethereum NFT, you’ll have to buy some ETH. Firstly, how much is the NFT you want to buy? There are 2 ways to get eth into your metamask wallet.

- You can buy crypto for the first time on a Centralized Exchange such as Coinbase or Binance and send it to your Metamask wallet.

- Alternatively, you can buy crypto with your metamask wallet using Moonpay. Make sure to transfer a bit more to your wallet though. Every time you buy an NFT, you must pay a gas fee.

How much does it cost to buy an NFT?

For the full scoop on how it works check out our article on NFT gas fees. However, basically, each time you adjust the blockchain, you must pay a fee. This includes creating, changing, or destroying NFTs. In short, fees are dependent on network congestion: the more people interact with NFTs, the more you have to pay to transact. Check out our guide on guaranteeing the cheapest NFT gas fees to learn more.

Where can I buy NFTs?

Most NFTs are available on NFT Marketplaces. Basically, these platforms allow you to buy, sell, auction, and sometimes mint NFTs. In this guide, we will focus on the most popular NFT marketplaces. However, there are some great NFT marketplaces on Solana and even a generative art marketplace on Tezos too.

For fine art and digital art from established artists, try Foundation, hic et Nunc, SuperRare or Nifty Gateway. These sites are either more specialized in their focus or have more selective criteria for accepting artists.

However, if you’re looking for something general, or don’t know what you want to buy just yet, let’s look at the most popular marketplaces of today: Opensea.

OpenSea has the advantage of a highly user-friendly interface. While it remains the most popular marketplace for NFTs on Ethereum, it’s not without its competitors these days.

How to buy an NFT on Opensea in 5 steps

- First you will have to make an account on Opensea. It will require you to connect your wallet.

- Next, find the NFT you like. If you’re unsure, check out some of the trending collections.

- Click Buy Now.

- A window will pop up in metamask asking if you would like to approve the transaction. Make sure to check that the gas fee is reasonable and you are interacting with the correct contract.

- If so, approve the signature and you should have your first NFT! It sometimes takes some time for the system to approve your transaction. If your transaction is stuck, check out our guide on NFT gas wars.

Popular NFTs you could buy: From CryptoPunks to Apes

A great place to start is buying NFTs from blue-chip, or established, NFT collections. For example, CryptoPunks have always enjoyed high floor prices because of their status as the OG NFT Collectible. The only collection to ever top it is the equally famous Bored Ape Yacht Club.

These collections have the ultimate bragging rights, with collectors paying millions for a single non-fungible token. To illustrate, anything that comes from the Yuga Labs collective seems to do well in the industry. If you’re looking for a more accessible price point, check out Otherdeeds and Meebits. Other big collectibles include Deadfellaz, Veefriends, and CloneX.

If you’re looking for generative art instead, a great place to start is with Artblocks or fxhash. Alternatively, you might want to hunt for something that appeals more to you specifically.

How to choose which NFT to buy

So, when looking for an NFT that suits you, which NFT is best to purchase? Well, there are many elements to consider when assessing an NFT’s value. If you’re buying NFTs to make money, the following aspects will help you make a good investment.

1. Trusted and Respected Founders

Who are the creators and are they trustworthy? The quality of the work and the track record of the artist or team will make a massive difference to its value. People want to buy NFTs from respected NFT artists and successful web3 companies.

2. Rare or Scarce NFTs

Does it have rare traits? Is it a unique 1:1? You can easily calculate NFT Rarity using a number of tools. These can determine whether you should be buying that particular NFT at the floor price or above. In short, the rarer an NFT, the more expensive it will be. If you invest in a rare NFT at the floor price, you can make a lot of money!

3. Benefits and perks

Are there any real-world or online perks to buying this NFT? Some collections offer NFT events like Bored Ape Yacht Club with Apefest and Veefriends with Veecon. Others offer simply branded merch drops or secondary NFT collections.

4. Good Ranking on NFT Analytics sites

The bidding history can also help guide your decision-making process. If an NFT was created six months ago and has yet to earn a single bid, or if its price is being regularly reduced, that may be a bad sign. If it’s reaching the top of NFT analytics sites, then maybe it could be a good investment.

5. A Reasonable Price

Firstly, is it a good value for money? Many cash grabs and failed projects had an exorbitant mint prices. A good NFT to invest in will have a reasonable price. That being said, that doesn’t mean every NFT should be cheap. Some NFTs are ambitious and need the funds to carry out their plans. However, if they are too ambitious, that could be a red flag.

6. A Vibe

Perhaps most importantly, though, is how you feel about the work. After all, the difference between an obscure undiscovered artist and a superstar can often come down to their making that first fateful sale. That being said, there are a few red flags to watch out for when investing in unverified NFT collections.

Don’t buy An NFT Collection with these red flags

Although you can’t always be sure, I’d be wary about buying any NFT project with the following red flags. Remember, even signing one malicious transaction could wipe your whole crypto wallet of NFTs.

1. Artists with sparse biographical information and lightweight write-ups.

While you’re not necessarily looking for a New York darling making their first foray into crypto art, you should also be wary of creators who are only interested in NFTs to make a quick buck. You’re buying a slice of the artist’s reputation as much as an image, so try to avoid people who won’t even be artists a year from now.

2. Anonymous founders and developers

As a buyer, you should definitely watch out for anon projects. Don’t get swayed by the hype. Knowing the team should be one of the first things you cover when doing your due diligence. While an anonymous founder may not always pose a risk, just look what happened with Bored Cat Club, The Tokyo Ten, UncOvered, and Evolved Apes.

3. NFT Collections with Bots and suspicious engagement

Is the discord chat moving suspiciously fast with users spamming “GM”? Do their social media accounts have hundreds of thousands of followers and no engagement? These are all tell-tale signs of manipulation. Often, projects aiming to create hype inflate their follower numbers. This can be a huge red flag when deciding which NFT to buy.

4. Collections with Extremely Ambitious Roadmaps

You know what they say: If it seems to good to be true, it probably is. If a roadmap promises to gift $10 Million to one lucky winner, but only costs $5 per NFT, the math just doesn’t add up. Don’t fall for simple scams that make highly ambitious promises with no foundation.

Other options for Cautious NFT Investors

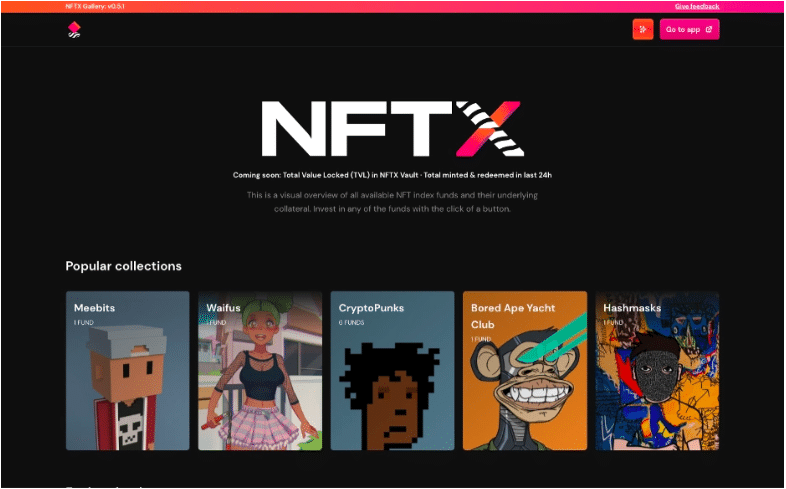

Since backing a single work by a single artist can be something of a gamble, there are other ways to invest in NFTs without having to become an amateur art expert. NFT Indexes allow you to purchase a portion of an existing well-known NFT so that as the base artwork rises in value, so does your investment. NFTX does this for popular NFT brands, while NFT20 allows you to invest in fractional amounts over time.

Should I buy on-chain or off-chain NFTs?

At its core, NFTs are non-fungible, indivisible, indestructible, and verifiable. However, storing files on a proof-of-work blockchain like Ethereum can be energy consumptive and rather expensive indeed.

For this reason, many NFT collections choose to store the image and unlockable content Off-chain. That means the real image may actually live on the internet. This means while the NFT is indestructible, the image itself is not. To explain, the contract owner could change the off-chain files at any point – meaning your cute raccoon NFT might turn into a pile of bones. To learn more about how to avoid rug pulls like that, check out our guide on where NFTs are stored.

For example, cryptopunks are stored completely on-chain. Then, Cryptoskulls are on-chain NFTs too. In short, it is impossible to ever destroy these NFTs or their images. NFTs stored on-chain are the safest NFTs in existence.

Is Investing in NFTS a Good Idea?

Investing in NFTs in 2023 can be a compelling opportunity given the transformative impact they continue to have across various sectors. In the realm of art, NFTs empower artists with unprecedented control over their work and revenue streams, as demonstrated by Beeple’s $69 million auction.

Gaming experiences, as seen in Axie Infinity, have shifted towards true ownership of in-game assets, allowing players to monetize their skills. The collectibles market, exemplified by NBA Top Shot, has been redefined, introducing digital ownership with scarcity dynamics that increase value over time.

Furthermore, NFTs have penetrated finance, enabling fractional ownership of high-value assets through platforms like Fractional.art. In the intellectual property space, NFTs are strengthening creators’ rights and helping brands like Hermès and Nike protect their trademarks in the digital realm. As we embrace the metaverse era, NFTs play a pivotal role in defining virtual identities and properties within digital landscapes like Decentraland, creating new economic paradigms.

With Apple’s Vision Pro headset entering the scene, NFTs in the metaverse gain enhanced significance, bridging the gap between physical and digital realities. In 2023, NFTs present a dynamic landscape of opportunities, reshaping traditional models and offering investors a diverse portfolio with potential for growth and innovation. But it’s also crucial to acknowledge that every market experiences fluctuations. As with any investment, individuals must carefully assess their risk tolerance and financial situation.

Investing in NFTs in 2023

The NFT market, once characterized by seemingly guaranteed profits, has undergone a significant transformation since 2021. In the earlier days, being on the whitelist often meant a surefire opportunity to flip NFTs for profit. However, the landscape has evolved, and the dynamics have shifted. Notable releases in 2023, such as Azuki, have shown that success is no longer a given. Azuki’s performance didn’t meet expectations, underscoring the current unpredictability in the market.

Despite this change, certain sectors within the NFT space continue to show promise. NFTs in the realms of fashion, gaming, and music have captured attention. Fashion brands are exploring NFTs as a means of digital authenticity and ownership, while the gaming industry continues to integrate NFTs for true ownership of in-game assets. In the music space, artists are exploring NFTs not just as collectibles but as a novel way to engage with fans. While the era of guaranteed flips may have faded, strategic investments in these evolving sectors offer potential avenues for those navigating the contemporary NFT market.

The Future Of NFTs

The future of NFTs in 2023 is both promising and dynamic, poised for continued innovation and widespread integration across industries. The evolution of NFTs, from their initial prominence in the art world to applications in gaming, virtual real estate, and the music industry, signifies a broadening scope of digital ownership. The introduction of fractional NFT ownership democratizes access to exclusive assets, while the role of NFT development services becomes increasingly pivotal in crafting secure smart contracts and addressing interoperability challenges.

Anticipated trends for 2023 include the seamless integration of NFTs with augmented reality, revolutionizing how digital assets are experienced in the physical world. In the music industry, NFTs are set to redefine fan engagement and royalty payments, ushering in a new era of direct compensation for artists. Sustainability concerns will drive the adoption of eco-conscious blockchains, aligning the NFT ecosystem with global environmental efforts. The expansion of NFT use cases beyond art and collectibles into real-world assets, charitable causes, and virtual economies further underscores the transformative potential of this technology.

Despite the uncertainties brought by a prolonged bear market, there is a steadfast belief that NFTs will continue to play a significant role in shaping the future of digital ownership. While acknowledging the challenges and risks, including value volatility and environmental concerns, the faith in the enduring impact of NFTs remains a guiding principle as the technology navigates the complexities of the digital landscape.

All investment/financial opinions expressed by NFTevening.com are not recommendations.

This article is educational material.

As always, make your own research prior to making any kind of investment.