Blur has a stranglehold on the NFT lending industry. Since the controversial NFT exchange began offering lending services to NFT collectors last month, it has managed to control 82% of lending volume. What is going on with Blur’s NFT lending program?

The Blur NFT Lending Program

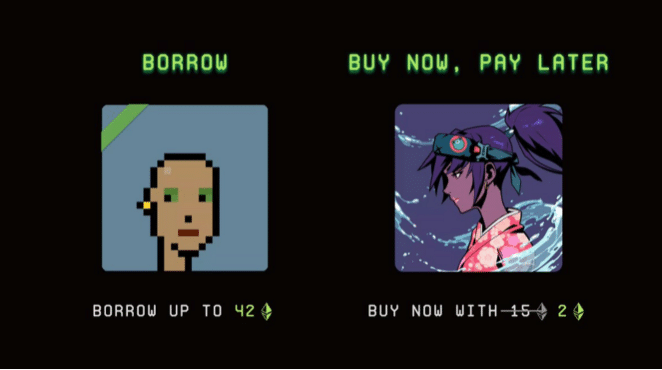

Blur made a huge announcement last month. It would pivot into offering collateralized loans for blue-chip NFT holders. Additionally, buyers could also purchase NFTs by paying a downpayment upfront and financing the rest of their purchase. This program is called Blend, and since its launch, has proved extraordinarily popular.

Over the last 22 days, Blur has managed $308m in loan volume. This figure accounts for an 82% share of the total lending volume of $375m in May. Blend has become so successful, in fact, that this volume currently represents 46.2% of the exchange’s operations.

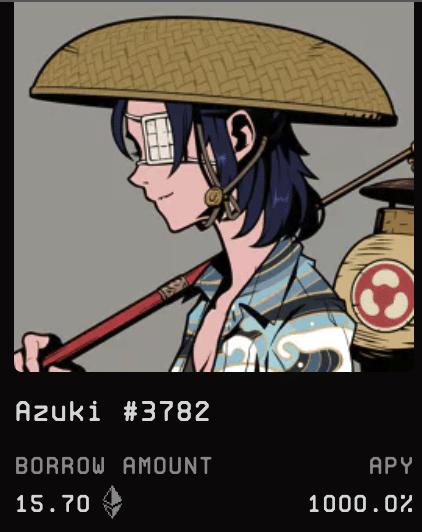

Blend users are primarily targeting the Azuki collection. Known for its excellent art and wealthy collectors, Azuki provides a relatively stable floor for loan operators to work with. To date, Azuki has seen $127m in loan volume. The platform also supports loans for other top NFT collections including CryptoPunks, Milady Makers, DeGods, Bored Ape Yacht Club, and Mutant Ape Yacht Club.

So far, high net-worth collectors have dominated lending volumes. This isn’t surprising given that Blur is rewarding Blend users with their newest airdrop. As a result, whales are farming this airdrop by pouring money into the Blend platform. The more loans they offer and take out, the more lending points they receive and the bigger airdrop these individuals will eventually receive.

Image Credit: Coinmonks

How Has Blend Impacted the NFT Market?

Like Blur’s earlier airdrop campaigns, Blend has had a ripple effect on the rest of the NFT market. Initially, prices nudged upwards as Blend unlocked liquidity that was previously locked up in NFTs. Some holders posted their expensive items as collateral to buy other NFTs, hoping they’d be able to execute profitable trades before needing to pay sometimes exorbitant borrowing costs. Furthermore, some buyers took advantage of Blend’s low money-down financing options to buy NFTs for a fraction of their costs.

Despite its success, some members of the NFT community have been critical of Blend. Jonathan Gabler, the co-founder of alternative NFT lending protocol NFTFi, stated that “Unchanged, the current incentive design will likely lead to bad outcomes for borrowers such as mass defaults or liquidations of high-risk loans, flush NFTs into the hands of point farmers, and in consequence, may lead to much higher market volatility. Existing peer-to-peer protocols tend to be more borrower-friendly and lead to healthier loan markets.”

Image Credit: Blur

Regardless of any controversy, Blur has continued to assert itself as a disruptive player in the NFT market. The exchange’s Blend program is another example of its willingness to innovate to meet customer demands. Moreover, it also demonstrates Blur’s understanding of its customer base- give NFT buyers a means to buy more NFTs and they will jump at the opportunity.

All investment/financial opinions expressed by NFTevening.com are not recommendations.

This article is educational material.

As always, make your own research prior to making any kind of investment.