NFTs have become a hot topic across industries. With new projects from artists, celebrities, and brands dropping every other day, investing in NFTs has become as exciting as ever, and even easier. This year, the NFT market has grown astronomically, amassing over $10.7 billion in Q3 2021 alone. If you have been planning on investing in NFTs, this would be the best time to start!

While the exorbitant price of some of the NFTs is a major deterrent, here’s the good news: there is more than one way to invest in NFTs, including without actually buying one. Yup, you heard that right. We’ll get to that in a minute. First, let’s take a look at what you’ll need before you can start investing.

NFT investing: Getting started

Here are the first steps to get you started on your NFT investing journey, especially if you are directly buying NFTs:

- Choose a crypto wallet: As a crypto wallet is where you will store your NFTs and cryptocurrencies, choosing the right crypto wallet is critical. Metamask is the most widely used online wallet. You can also try Trust Wallet, Enjin, or Coinbase. Alternately, you can opt for a hardware wallet where your assets will be stored offline.

- Buy crypto from an exchange: Of course, you’ll need some cryptocurrency to invest in NFTs. You can buy the coins from an exchange and how much you buy will depend on your investment plans. You must also make sure that the crypto you buy corresponds with the NFT you’re planning to purchase.

- Transfer coins to your wallet: As most exchanges use an integrated wallet, you’ll have to first transfer the coins you purchased to your own wallet. For this, you can simply click on the transfer/send option on the exchange and then follow the prompts.

Trade NFT directly

The obvious way to invest in NFTs is directly buying them. There are scores of NFT projects and NFT art by various artists out there—it’s only growing by the day. You can easily invest in NFT art and collectibles by purchasing them on different NFT marketplaces. Depending on your interests and the type of NFT you are looking for, there are plenty of marketplaces to choose from.

Choosing a marketplace

OpenSea, the first peer-to-peer marketplace, is the most popular Ethereum-based marketplace. To date, it has amassed over $11.5 billion in trading volume—the highest for any marketplace (at the time of writing). Along with Ethereum, it also supports blockchains Polygon and Klatyn. Rarible is another highly-sought after marketplace and has raked in over $272 million in sales so far. Both OpenSea and Rarible are user-friendly and offer a range of NFTs, including collectibles, trading cards, and music NFTs. However, the latter has better customer service.

Certain marketplaces, however, are known for a particular category of NFTs. For instance, SuperRare and Foundation are best for 1/1 artworks. These are a great choice whether you are looking for artworks from acclaimed artists like Hackatao and FEWOCiOUS or even lesser-known creators. On the other hand, if you’re into music and want to bag some music NFTs, then music-focused marketplaces like Catalog, Async Music, or OneOf are your best bets.

Now, if you want to get your hands on any celebrity drops, then Nifty Gateway is a great choice. The platform hosts NFTs of a slew of celebrities, including Paris Hilton and Eminem. Ultimately, whichever marketplace you choose will have NFTs at varying prices. So, do your due diligence and choose one that you can afford and makes for a sound investment.

Once you have selected a suitable marketplace and an NFT (or NFTs) you like, investing in NFTs directly is pretty straightforward. Simply create an account on the marketplace, connect your wallet, and then click on the buy/purchase option on the platform and follow the steps. If it’s an auction, you’ll have to place bids.

Investing in ERC-20 tokens

Another excellent way to get involved in the booming NFT ecosystem is by investing in ERC-20 tokens. These can represent a range of items, including utility tokens and governance tokens. The former is essentially an in-game currency popular in many metaverses and play-to-earn games that players use to purchase various digital assets. It can also come with other benefits.

For example, Decentraland’s utility token, MANA, can be used for various transactions within the metaverse, including to buy accessories, collectibles, and other assets. Alternately, you can trade MANA in a wide range of crypto exchanges or stake the token to earn a passive income.

Certain ERC-20 tokens also function as governance tokens wherein the holders get voting powers. To illustrate, the top P2E game, Axie Infinity, offers governance tokens called Axie Infinity Shards (AXS). AXS holders get to vote on important decisions such as game functionalities and treasury funds spending. This is significant from a decentralisation point of view as a community decides a project’s future and not a central entity/company.

As NFTs are integrated into many of these projects (LAND parcels in Decentraland and Axies in Axie Infinity), holding these tokens helps you to become a part of the wider NFT community. In some cases, like with NFT project Meme Protocol’s MEME token, staking the token gives you access to exclusive NFT drops. With metaverses becoming more mainstream, the value of these tokens is also skyrocketing.

Buy fractions of NFTs

As NFTs are a speculative asset, the safest option is investing in blue-chip projects. But, of course, these are not easy on the pocket. A CryptoPunk NFT today costs an average of over $115,000. A BAYC, on the other hand, costs about $34,000, according to DappRadar (at the time of writing). However, there is a way to invest in any top project by spending just a few dollars: meet fractionalized NFTs.

In fractionalization, users split their NFT into a number of ERC-20 tokens, thereby making NFTs a liquid asset with collective ownership. There are several platforms that allow users to fractionalize NFTs, such as NIFTEX and Metapurse. You can then invest in these fractional NFTs on a DEX (decentralised exchange) like Uniswap. Thus, you will be able to invest in even a CryptoPunk with as little as $10!

Investing in NFT index Funds

For cautious investors, another way to get involved in NFTs is by investing in NFT index funds. An index fund is a financial instrument that tracks the value of a group of assets. It is a form of passive investing where you can own a portion of a well-known NFT, wherein the value of your investment rises with the rise in the base NFT’s value.

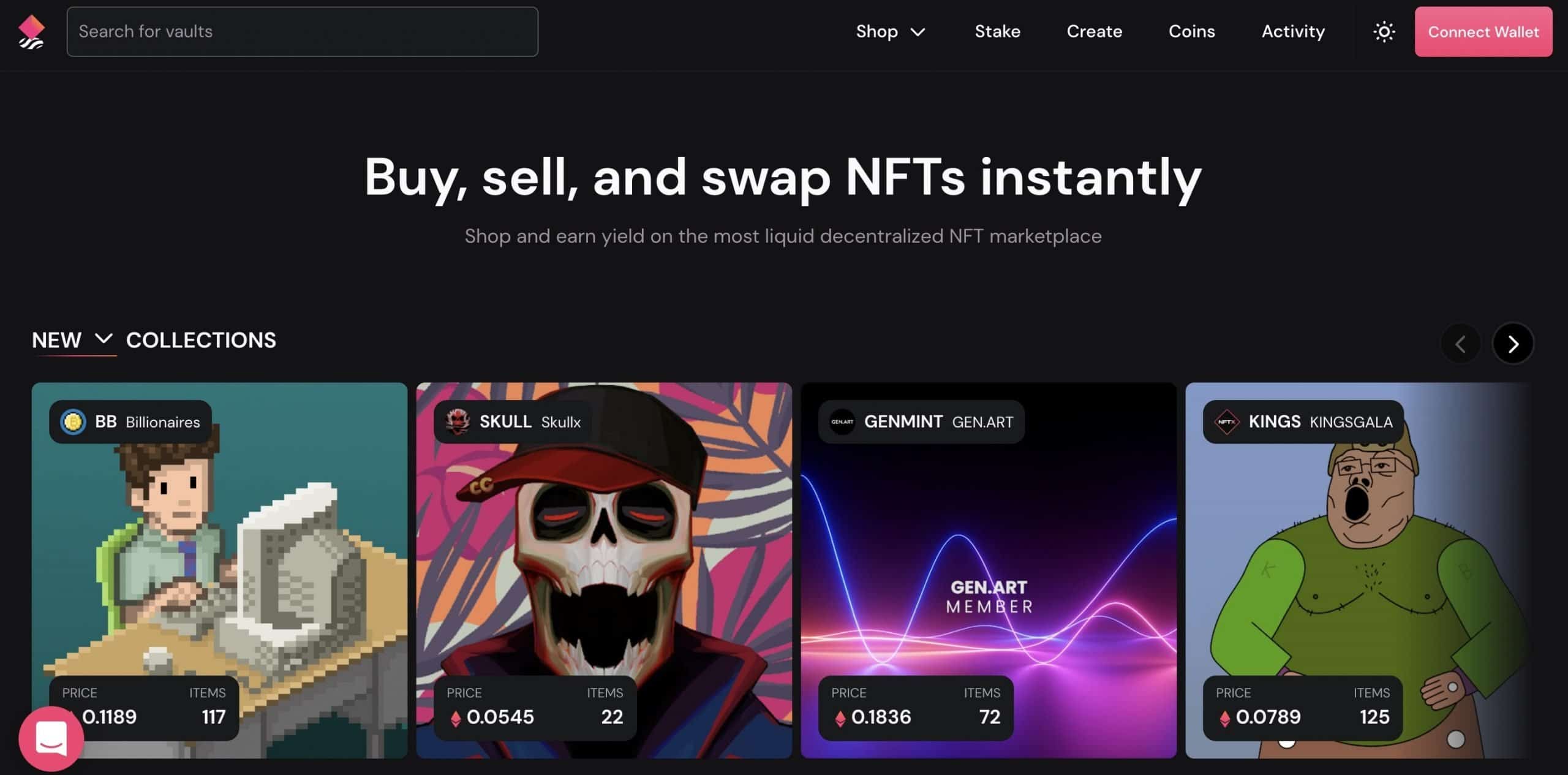

This way, you won’t have to closely monitor each asset before investing. It also offers broad market exposure at low operating costs. If this is something you are interested in, you should try NFT index projects like NFTX and NFT20.

On similar lines, you can also invest in MVI index (Metaverse Index), an index fund created by the Index Coop DAO. According to the website, the fund contains 15 tokens that capture the “trend of entertainment, sports and business shifting to a virtual environment.” Essentially, the fund aims to turn the interest in metaverses into “a single investable token.”

Lend Crypto to NFT users

With NFTs’ surging popularity, there are scores of people who want to hold onto their precious NFTs but at the same, look into other investment channels. This scenario has led to the birth of the NFT DeFi lending market. Put simply, people put up their NFTs as collateral in exchange for crypto. If they don’t pay it back in time, they lose the NFT.

NFTfi is one of the widely used platforms that allow people to borrow against their NFTs. Last month alone, the platform arranged $8.6 million worth of loans, according to The Defiant. Clearly, there is a growing demand for lending crypto to NFT users and will be something you can consider to get NFT exposure without actually buying NFTs.

Depending on the popularity of the NFT, the annual interest rates can vary from 20% to 80%. While there is a risk of the borrower defaulting on the loan, you can keep the NFT in such an event. In some scenarios, the value of the NFT can also soar during the loan period. For example, a collector who borrowed 3.5 ETH (around $12,600) against their NFT worth 11 ETH ($39,600) at the time, failed to repay it three months later. However, by this period, the floor of the NFT in question—an “Elevated Deconstructions” NFT—shot up to $342,000, reported The Block.

As you can see, there are numerous ways for you to get exposure to NFTs. However, whichever option you chose, make sure you have a clear budget in mind. Additionally, it is important to carry out proper research and diligently consider the risks involved, before making the leap.

All investment/financial opinions expressed by NFTevening.com are not recommendations.

This article is educational material.

As always, make your own research prior to making any kind of investment.