Welcome to the “all-in-one” NFT guide for you to get an in-depth look at what NFTs (or digital collectibles) are. In 2023, the word NFT draws meaning highly dependent on context. NFTs have made it into the mainstream in both language and culture, more specifically internet culture.

So, what exactly is an NFT? What does NFT stand for? Why are NFTs selling for millions of dollars? These are some of the questions you may have when new to the NFT community.

NFTs gained prominence in 2021, especially after NFT artist Beeple scripted history by selling his NFT art for $69 million. Since then, NFTs have taken the digital world by storm, with artists, celebrities, global brands, tech giants, and more hopping on the bandwagon. In a short span of time, Non-fungible tokens, or NFTs, have made their way into sectors of all kinds, including art, finance, sports, fashion, and gaming, to name a few.

Though NFTs are going through a (sort of) downturn in 2023, their acceptance and adoption into multiple industries has not slowed down.

This comprehensive NFT guide contains all the information you’ll ever need to understand NFTs and more. Within this guide, we’ll walk you through the definition of NFTs, the technology underpinning them, the process of creating and trading NFTs, and whether you should consider participating. For detailed insights on each topic, simply follow the provided links in this article.

What is an NFT?

Non-Fungible Tokens (NFTs), are unique digital assets recorded on a blockchain. Unlike cryptocurrencies like Bitcoin, NFTs are non-fungible, meaning each one is distinct and cannot be exchanged for another of equal value, much like original physical artworks.

An example of their “non-fungibility” – NFTs are similar to how Pokémon trading cards represent distinct characters. Just as you wouldn’t trade a “rare holographic Charizard card” for a common one.

NFTs cannot be directly swapped with each other, even if they share similar values. Each NFT has its own distinct identity, making them non-fungible, much like Pokémon cards with their unique attributes and rarity.

- You may have seen many examples of NFT projects bloom in the years leading to 2023. Some notable examples are the Bored Ape Yacht Club, Doodles (with Grammy winning artist Pharell as creative director), Cryptopunks, among many others!

The necessity of a blockchain for digital files lies in establishing ownership and property rights. While digital files are easily copied, NFTs publicly and permanently record metadata, including creator information, ownership, and resale royalties.

This differentiation guarantees that while numerous copies may exist, sole ownership of the authentic original belongs to one individual, paving the way for fresh markets and platforms for digital items and artwork.

If you want to learn more about the details, make sure to check out our first guide on what an NFT is in the first place!

How Do NFTs Work?

To grasp NFTs, you need a little background around the technologies behind it that make it work – the blockchain.

Imagine a chain made of digital links. Each link is a block, holding data. Now, each block has a super-strong, unbreakable password (like a hash) that connects it to the previous block, forming a chronological record, like a history book (or a ledger in book-keeping terms).

In cryptocurrencies, like Bitcoin, these blocks track transactions. Other blockchains might store different info, like smart contract steps.

Here’s the cool part: public blockchains are open to everyone and copied across many computers (making them decentralized).

The network double-checks info before agreeing on changes, and those unbreakable passwords make tampering very tough. So, blockchain is like a secure, shared digital history book that’s nearly impossible to alter.

What are Some NFT Use Cases?

When most people hear the word “NFT” they directly think “monkey pictures” or some sort of abstract art they can’t really define. But NFTs are more than pictures on a blockchain. They unlock new ways of verification and provide fuel to ecosystems across industries. Though NFTs are a mostly novel concept, their use-cases have already garnered widespread attention and usage in various enterprises.

Digital Use Cases

Below are some of the digital use cases of NFTs:

- Digital Art: Auction houses like Sotheby’s and Christie’s are exploring NFTs to authenticate and protect digital art, offering creators rightful attribution and buyers a unique digital identity.

- Collectibles: NFTs bring scarcity to digital collectibles. Some examples include the NBA selling video snippet NFTs of memorable game moments, Marvel creating limited digital figurines, Funko Pop! bringing exciting pop culture collaborations.

- Memberships and Ticketing: NFTs verify and transfer club memberships or sports season passes, granting access to exclusive clubs. Event tickets can be legally resold, filling seats and paying royalties, as seen with Coachella.

- Games: NFTs fuel unique in-game assets and metaverse experiences. The BAYC Metaverse “Otherside” is an exclusive metaverse gaming platform being developed for BAYC NFT holders. CryptoKitties lets users breed digital cats, and NFT horse racing allows virtual races based on digital horse genetics. Furthermore, there are other platforms such as Sorare – that take NFTs and tie it to real-world sports such as Soccer or NBA etc.

IRL Use Cases

NFTs can also be used for various IRL situations, here are a few below:

- Dining: NFTs streamline restaurant reservations, address ‘no-shows,’ verify reviews, and even create exclusive member-only dining areas.

- Education: NFTs can verify virtual credentials and micro-credentials, making it easier to display skills on resumes and academic results on platforms like LinkedIn.

- Supply Chain: NFTs merge physical and digital worlds, enabling tracking of shipments from factory to consumer. They also verify the authenticity of items like pharmaceuticals and luxury goods, and enhance the value of products like wine and whisky.

Nowadays, people can also take loans off of NFTs in lieu of real-world items. Just take this X thread about how someone sanctioned a $1,100,000 on-chain loan from a stranger using an NFT representing ownership of a complete set of Supreme Box logo T-shirts as collateral.

Other Benefits

- Customer Experience: NFTs create direct connections between creators and buyers, fostering brand loyalty. Brands like TheHundreds use NFTs to offer exclusive access, while Nike has patented NFT-linked shoes. Roblox also heavily fuses NFTs within its ecosystem to draw more connections to their playable metaverse. Furthermore, hundreds of brands already collaborate with Roblox, and NFTs are a crucial part of their meta-experience.

- Community Building: NFTs allow artists and creators to build communities and narratives around them. This further enhances the creator economy and allows holders to experience their favorite artists and their creations in new ways.

- Investment: As NFTs gain significant value, they evolve into a speculative asset class attracting investors looking for opportunities. Though the NFT market of today faces a slump, there is an immense potential blooming on the horizon for the asset class. Especially as technology and virtual worlds start to grow and expand.

These diverse applications highlight the expanding and transformative potential of NFTs across various industries.

Please note that some of the technology behind some NFT use-cases (such as events) also include Proof Of Attendance Protocols (POAPs). Here’s a brief brush up on what POAPs basically are:

Proof Of Attendance Protocol (POAP)

A POAP is a digital collectible called a POAP NFT, short for “Proof of Attendance Protocol” NFT. It represents your participation in an event, securely recorded on a blockchain. These NFTs hold memories, can reward community participation, and aren’t typically for investment. For more info about POAPs, please refer to our POAP guide here.

What are Some of the Top NFT Projects in 2023?

Amidst a brutal NFT bear market, there are still a wide array of projects pulling through. The top projects in the space are currently ‘heads down building’ for their communities. These projects, with their resilience, utilities, and community, ensure that the NFT space is here to stay.

A thousand different projects launch every year, but only some of them stay and make it through the years. Moreover, only some collections have the potential to become one of the most expensive NFTs of all time.

Here’s our collection of projects you should know about.

Profile Picture Projects

Also named PFP projects, these collections boast unique avatars. Often community members use them as social media profile pictures. For an outline of what that means, you’ll need our guide to the best NFT avatar projects. Firstly though, every NFT collector should know about the following projects:

- Bored Ape Yacht Club

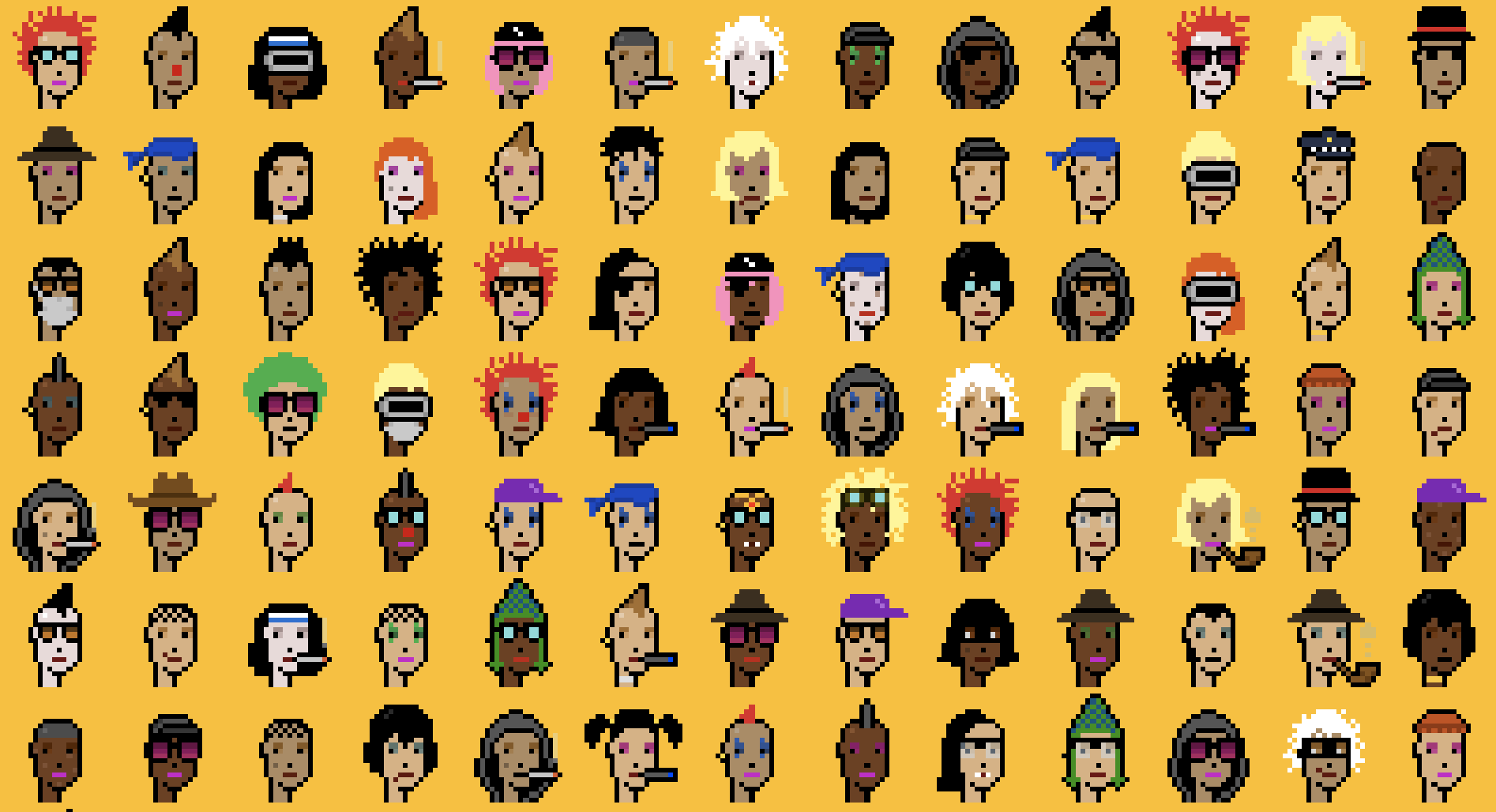

- CryptoPunks

- Doodles

- DeGods

- Deadfellaz

- Azuki

- Cool Cats

- VeeFriends

- World Of Women

NFT Art 101

Recently, NFT artists DJ Agoria and Refik Anadol showcased their latest art in a summer art festival in Mykonos. Many art pieces end up selling for incredible amounts. Moreover, meme projects have also taken over as massive infrastructures within the NFT Art ecosystem. Take the iconic rise of $PEPE, for example.

While many artists, such as Trevor Jones and Pak, are simply digital artists, non-fungible tokens added another layer to art: Generative Art. Generative Art NFTs increased in popularity in 2022. Despite the bear market, it still gained traction. The best Generative art projects today include:

Every year, new and OG artists both find ways to reinvent themselves, take for example

- Art Blocks

- Tezos’ fxhash

- Robert Alice

- Tyler Hobbs

Blockchain Games

Web3 loves games and there are countless to get involved with. NFTs birthed a whole new genre: Play to Earn. In short, play to earn mechanics allow the player to earn crypto whilst having fun. Sounds too good to be true? It’s not – we swear. In fact, you can earn money playing games too!

Meanwhile, earning is not for everyone. If Pokémon is more your thing, check out our guide on the best blockchain trading card games.

The following blockchain games are well known and respected – and rightfully so in our opinion. You won’t want to miss these as a true gamer of any genre:

- 9 lives arena

- age of rust

- Axie Inifinity

- alien worlds

- blankos block party

- crypto unicorns

- Dark Country

- Gods Unchained

- legends of elumia

- legends of the metaverse

- lost relics

- Mist game

- neon district

- nine chronicles

- The Otherside Game

- sorare

- spells of genesis

- splinterlands

- STEPN

- yaku corp

- Zed Run

Music NFTs

Music NFTs are also slowly but steadily garnering attention in the web3 space. Lots of dominant and dormant forces to get acquainted with here. To get your web3 music career going you need the following guides:

- Ultimate guide to Music NFTs

- Music marketplace Royal

- Web3 Record Labels

- LimeWire

Cinema NFTs

NFTs have also entered the sphere of films and TV. With many different activations across various spheres and elements of television media, including web series, cartoons, nostalgia activations, movies, short films, and more – NFTs unlock new angles to the film industry narrative. Heck, we even have the world’s first ever NFT actor this year!

Sports NFTs

Sporting tokens and web3 projects were huge in 2021. While the initial hype died down, there are still plenty of opportunities to get involved with some of the sporting industry’s coolest projects. If you’re a sports lover, you must see the full list of best NFT sports projects. Meanwhile, here are our guides to some of the community favourites:

NFT Fashion / Web3 Fashion

NFTs are revolutionizing the fashion industry by introducing digital ownership and authenticity to clothing and accessories. Fashion brands and designers are creating NFT collections, allowing customers to own unique digital fashion items that can be displayed in virtual environments or even worn in metaverse spaces.

These digital garments not only provide a new level of personal expression but also challenge traditional notions of fashion ownership, sustainability, and exclusivity. NFTs are redefining the way fashion is experienced, bought, and shared in the digital age. A few web3 fashion brands to look out for are as follows:

Metaverse

NFTs are also an important part of what the metaverse is. Essentially, a metaverse is a 3D virtual world that incorporates a slew of tech such as virtual reality (VR), augmented reality (AR), and mixed reality (MR) into our daily lives. Within the virtual world, non-fungible tokens represent a range of items including avatars, wearables, virtual land, vehicles, weapons, and so much more.

Digital real estate usually serve as unique plot of land in the metaverse, with NFTs representing each parcel of land. Just like in the real world, you can do pretty much anything with your digital real estate. You can build virtual houses, shops, and galleries, set up casinos and even host parties!

To help you learn about the most popular metaverses, we’ve created some highlights on the biggest of them:

Then, if you’re considering buying virtual land, make sure follow our outline in: How To Buy Metaverse Land.

Is it Worth Buying an NFT in 2023?

Warren Buffett once said: ”Be fearful when others are greedy, and be greedy when others are fearful”. In one of the worst NFT down markets, the question remains – are NFTs still a good buy?

The question however, loses its charm without context. NFTs are indeed here to stay, but the same old promises around roadmap utilities and PFP project hype cycles are slowly fading into the background.

In the new era of NFTs, they are valued by the connections and engagements between their communities, real-world value they produce, and their immediate expansion plans.

However, what NFTs are doing is creating a new way to experience creators and brands. The reliability and decentralized nature of NFTs ensure that NFT technology is here to grow.

Why You Should Buy NFTs

There are more than a couple of reasons why NFTs sell like hot cakes:

- Traceability and transparency: Each token is completely unique—much like a digital signature. And thanks to transparency conferred by blockchain technology, you can easily track an asset’s ownership and authenticity.

- Royalties: Non-fungible tokens make it possible for artists to create and sell their works independently, without having to go through middlemen. What’s more, they can earn lifetime royalties through every secondary sale of their digital asset.

- Potential Profit: Investing in non-fungible tokens has the potential to help you gain high returns. For example, CryptoPunks, which were originally available for free, today costs at least $135,000 (at the time of writing).

- Community: Community is an integral part of most NFT projects. NFTs are a new way to interact and engage with your community. NFTs and community tokens also incentivise a creator community and help build projects to larger scales than ever before.

For a deeper look at the reasons to buy NFTs, read our guide: Why buy NFTs?

How Do I Buy NFTs?

Buying NFTs (or digital collectibles) involves a few easy steps. Here’s a general guide on how to buy NFTs:

Wallets & Marketplaces

- Get a Cryptocurrency Wallet: Most NFT transactions require you to use cryptocurrencies like Ethereum (ETH). So, you’ll need a cryptocurrency wallet to store your funds. MetaMask, Trust Wallet, and Coinbase Wallet are popular options.

- Fund Your Wallet: Buy some Ethereum (ETH) or the specific cryptocurrency required for the NFT platform you plan to use. You can purchase ETH on popular cryptocurrency exchanges like Coinbase, Binance, or Kraken.

- Choose an NFT Marketplace: NFTs are typically bought and sold on specialized online marketplaces. Some popular ones include OpenSea, SuperRare, and Blur. Different marketplaces may have different types of NFTs and user interfaces.

Accounts & Collections

- Create an Account: Sign up for an account on your chosen NFT marketplace. You may need to connect your cryptocurrency wallet to the platform.

- Browse and Select NFTs: Explore the marketplace to find NFTs you’re interested in. You can use filters, categories, or search functions to narrow down your options.

- Bid or Buy: When you find an NFT you want to purchase, you can either place a bid (if it’s an auction-style listing) or buy it outright (if it’s a fixed-price listing). Follow the prompts on the platform to complete the transaction. Make sure you have enough ETH or the required cryptocurrency in your wallet to cover the cost.

- Confirm and Verify: Before finalizing the purchase, carefully review the details of the NFT, including its description, ownership history, and any associated royalties or terms. Verify that the NFT is indeed what you want to buy.

Complete The Transaction

- Complete the Transaction: Once you’re satisfied with your choice, confirm the transaction. This might involve signing a transaction with your wallet’s private key. Be aware that there may be gas fees associated with Ethereum transactions, so you’ll need some extra ETH to cover those fees.

- Ownership Transfer: After the transaction is complete, the NFT will be transferred to your wallet, and you’ll officially own it. You can view your NFT collection within your wallet or on the NFT marketplace.

- Store and Manage Your NFTs: Make sure to store your NFTs securely in your wallet. You can also choose to display or sell them on the same marketplace or others (even metaverses), depending on your preferences.

Do I Need Crypto to Buy NFTs?

Most NFT marketplaces only allow you to trade digital assets using crypto. So, yes, there’s a high chance you will need some. Most NFT marketplaces are now open to different chains, so one may need to use a wallet that is “interoperable” among multiple chains, or use separate wallets for each chain (and of course their native cryptocurrencies)..

Moreover, some projects or marketplaces may even use Polygon (MATIC) or ‘Wrapped Ethereum’ to set transactions.

Wrapped Ethereum

You may be wondering what Wrapped Ethereum (wETH) even is, look no further!

WETH, or Wrapped Ethereum, is a token on the Ethereum blockchain that makes it easier to use Ethereum within decentralized applications (dApps). It’s like a bridge, allowing ETH to work seamlessly with these apps, especially in the world of DeFi.

Converting ETH to WETH is simple, and they have the same value. In essence, WETH enhances Ethereum’s versatility and usability in the decentralized ecosystem.

How to Use wETH While Buying NFTs

Using WETH to buy NFTs involves a simple process. Here’s a step-by-step guide:

- Get WETH: Convert your ETH to wETH using platforms like Uniswap or wallets with built-in conversion.

- Wallet Setup: Have a compatible wallet like MetaMask or Trust Wallet installed and connected to Ethereum.

- NFT Marketplace: Visit an NFT marketplace like OpenSea.

- Wallet Connection: Connect your wallet to the marketplace.

- Browse and Select: Choose your desired NFT.

- Purchase: Click “Buy” and follow the platform’s instructions.

- Payment: Confirm using your wallet’s WETH balance or convert ETH to WETH if needed.

- Confirm Transaction: Review and confirm, considering gas fees.

- Wait for Confirmation: Wait a few minutes for the Ethereum network to process.

- Ownership Transfer: Once confirmed, the NFT is in your wallet, making you the owner.

Now, you’ve successfully used WETH to buy an NFT. You can convert remaining WETH back to ETH on Uniswap if needed. Steps may vary by marketplace, so be cautious and verify NFT details.

Many NFT marketplaces allow credit card purchases with a crypto wallet. Bitcoin, Cardano, Solana, Tezos, and Flow also support NFTs.

How Do I Get A Crypto Wallet?

Getting a cryptocurrency wallet is a crucial step if you plan to buy, hold, or use cryptocurrencies like Bitcoin or Ethereum. There are different types of wallets available, including software wallets, hardware wallets, and mobile wallets.

Here’s how to get a cryptocurrency wallet:

Choose the Type of Wallet:

- Software Wallet: These are applications or software programs that you can install on your computer or smartphone. They are convenient for everyday use and are available in various forms:

- Desktop Wallet: Install on your computer.

- Mobile Wallet: Download from app stores for your smartphone.

- Web Wallet: Use a wallet that operates in your web browser.

- Hardware Wallet: These are physical devices specifically designed to store your cryptocurrencies offline, making them highly secure. Popular options include Ledger Nano S, Ledger Nano X, and Trezor.

- Paper Wallet: A paper wallet is a physical printout of your public and private keys. It’s a secure form of cold storage, but you need to be extremely careful not to lose or damage the paper.

- Brain Wallet: This type of wallet relies on you memorizing a passphrase that generates your keys. It’s secure if you choose a strong passphrase, but it’s also risky if you forget it.

Select a Wallet Provider:

- For software wallets, choose a reputable provider. Popular options for various cryptocurrencies include:

- Bitcoin: Electrum, Bitcoin Core

- Ethereum: MetaMask, MyEtherWallet (MEW)

- Multi-Currency: Exodus, Atomic Wallet, Rainbow Wallet

- For hardware wallets like Ledger, purchase from the official website or an authorized retailer.

- When using web wallets, ensure that the service provider has a good reputation and strong security measures in place.

Download or Purchase:

- Download the software wallet from the official website or app store for mobile wallets.

- Purchase a hardware wallet from the official website or an authorized retailer. Be cautious of third-party sellers to avoid counterfeit devices.

Install and Set Up:

- Follow the installation instructions provided by the wallet provider.

- During the setup process, you’ll often generate a new wallet or import an existing one if you’re transferring funds from another wallet or exchange.

Secure Your Wallet:

- Set a strong, unique passphrase or PIN for your wallet, especially if it’s a software wallet.

- For hardware wallets, follow the device-specific setup instructions, and store the recovery seed (usually a series of words) in a safe and offline location.

Test and Fund Your Wallet:

- Test your wallet by sending a small amount of cryptocurrency to it before transferring larger amounts.

Backup Your Wallet:

- Regularly backup your wallet’s private keys, recovery seed, or any other access methods provided by your wallet. Store these backups securely.

Use Your Wallet:

- You can now use your wallet to receive, store, and send cryptocurrencies. Be mindful of transaction fees and security practices when using your wallet.

Remember that the security of your cryptocurrency holdings depends heavily on the security of your wallet and how well you protect your private keys. Always exercise caution and use strong security practices to keep your crypto assets safe.

To help you make your own choice, we’ve compiled a list of the best crypto wallets for NFTs.

Which NFT Marketplace is Best?

To buy most NFTs, you’ll need to find an appropriate marketplace. Now, while there is a whole range of marketplaces to choose from, each caters to a specific need. To choose the best marketplace, read our in-depth guide on the best NFT Marketplaces. To start with though, here are the basics:

Ethereum Marketplaces For Beginners

These are the generic marketplaces with the most volume on Ethereum, and likely the most accessible.

NFT Marketplaces for Crypto Art and 1:1s

NFT Marketplaces for Music NFTs

Best Solana Marketplaces for Beginners

Looking to dip your toes into non-fungible tokens but Ethereum prices scared you away? Why not try some NFT marketplaces on Solana? If you want to know more, we’ve created an all encompassing guide on how to buy solana NFTs. Plus, don’t forget our introduction to the top NFT collections on Solana for some great investment ideas. But these are the top Solana marketplaces:

Staying Safe Buying NFTs

The NFT space has seen a significant uptick in scams, frauds, and hacks recently. To ensure maximum safety before investing, there are a few key steps one must take to ensure that their investments are safe.

- First, research the NFT marketplace you’re using, ensuring it’s reputable and secure. Only use well-known and trusted platforms.

- Secondly, double-check the details and ownership history of the NFT you’re interested in to avoid counterfeit or misrepresented items. Be cautious of deals that seem too good to be true.

- Thirdly, secure your cryptocurrency wallet with a strong, unique passphrase or PIN, and consider using hardware wallets for added security.

- Lastly, be wary of phishing attempts, always verify website URLs, and never share your private keys or recovery phrases with anyone. Staying vigilant and informed is the key to a safe NFT purchasing experience.

Nowadays, scams are rampant as hackers use social media platform “X” to social engineer people to drain them of their investments. Please be extra careful and verify the usernames of each NFT project(s) on X, visit their official websites, and only then make your purchase decisions.

From respected artists to doxxed founders, our guide on how to invest in NFTs will explain all you need to get started.

When To Buy NFTs?

Next, a good investment is all about being in the right place at the right time. While digital assets are often cheapest at a project’s launch, sometimes the floor price will drop post-reveal. To learn more about choosing your timing, you’ll need to read over when to buy NFTs!

Beyond that, there are a few hoops to jump through to get the best NFTs. Most projects have an allowlist or whitelist. Basically, these act as gated mints, access to which you may have to compete for or earn. For tips about allowlists, premints and more, make sure you study the criteria on how to get NFT whitelisted.

Gas Fees & Gas Wars

Before buying NFTs, you should be aware of Crypto gas fees. In a nutshell, you must pay miners gas fees or transaction fees to carry out each and every transaction on the blockchain. Yes, every single action you make on the blockchain costs money! As daunting as that may sound, you’ll find it easy with our full-length guide about NFT Gas Fees .

Next, if you’re vying for tokens on Ethereum, you must consider gas wars. These occur when the transaction fees are extremely high due to network congestion. If you don’t want to get caught in the ruckus, make sure to read our guide on how to escape NFT gas wars.

Security

At NFTevening we pride ourselves on keeping you up to date on the latest scams and rugpulls. That’s why we partnered with ledger to provide you with the latest and best guide on NFT security practices.

Learn how to stay protected with our NFT security 101 with Ledger.

How Do I Store My NFTs Safely?

While smart contracts are stored on the blockchain, the actual files included may not be. While some store the image files on-chain, like CryptoPunks and CryptoSkulls, others use decentralized hosting services like IPFS or Arweave. Still confused? Check out our guide on NFT storage to learn more!

How Can I Display NFTs

Once you buy a piece of digital artwork, how exactly do you display it? Well, lucky for you, you are spoilt for choice! There are multiple ways to display your NFTs.

Displaying NFTs

- Print and Frame: Print your NFT on high-quality photo paper and place it in a frame. For a premium look, consider printing it on canvas.

- Digital Frame: Use a digital frame to display your NFT. You can easily switch between different NFTs in the frame.

- Projector: Make a statement by projecting your NFT art. It can simulate the look of a real art gallery.

- Stickers: Turn your NFT into stickers and place them on various surfaces like laptops, smartphones, or even bottles.

- Augmented Reality (AR): Get creative with AR to display your NFT art in 3D and make it stand out.

- 3D Printing: For 3D NFTs, consider using a 3D printer to create a physical model of your NFT.

- Smart TV: Display your NFTs on a high-resolution smart TV like a Samsung QLED (or even an LG TV) for a traditional but impressive showcase. Samsung has also promised to come up with new technology for users to showcase and buy NFTs directly via TV!

- ”Phygital” Jewelry: Some brands like CryptoJewelerCo also allow collectors to rock their NFTs as physical drip, offering chains, watches etc that reflect their NFT collections to the world!

These methods offer unique ways to showcase your NFT collection in your home, adding to the enjoyment of owning rare digital art.

Furthermore, you may read our guide on ‘How To Display NFT Art’ to work out where to show off yours!

What If I Want to Make My Own NFTs?

Minting is the process of creating non-fungible tokens. As you should know by now, NFTs can be anything from digital or physical artwork to music, videos, and more. In 2023, it’s pretty easy to get your NFT ideas out there, and do it independently too!

There are numerous no-code tools like NiftyKit, Bueno, and other minting platforms that allow users to easily upload their files and take care of their end-to-end NFT needs. From creation, to minting, to selling out, royalties and beyond – these platforms allow creators (large and small) to create their NFT projects with little hassle.

Of course, the process will slightly vary from marketplace to marketplace. However, if you want to get started, here’s our guide: How to Create NFT Art: The Complete Beginner’s Guide.

If you have your artwork and don’t know how to mint it, our guide on NFT creator tools may be exactly what you need. Want to mint photos instead? Check out our dedicated guide on how to make Photography NFT collections. Alternatively, you could also

Selling Your NFTs:

Once you mint your NFTs, selling them is pretty straightforward but it’s not always easy. You’ll need rigorous marketing to actually sell the piece, especially if you are a newbie. Adding relevant utility or function to your project will make your digital assets more attractive. Our “How to Sell NFT Art” guide breaks down NFT marketing into the basics.

Sounds a bit too complicated? Fear not! Instead, you can employ someone else to do it for you. If that sounds more down your alley, we also have a list on the best NFT marketing companies you can find.

NFT Guides For Intermediates and Experts

If you have made it this far, congratulations—you aren’t a beginner anymore! If you are an NFT veteran (or just curious to know more about digital assets) this section is for you.

NFT Smart Contracts 101

Non-fungible tokens are all based on smart contracts. Put simply, a smart contract is a digital contract written in code and stored on the blockchain. They are automatically executed upon meeting certain pre-established conditions. In a smart contract, you can find everything from ownership and transaction details to custom trading rules and special rights. To learn more in-depth about what that means follow our crash course on what a smart contract is.

Beyond that, reading smart contracts is a skill that not many (but more should) have. If you want to get ahead, a great place to start is Etherscan. To explain, Etherscan is a “block explorer”. Essentially it allows you to read and interact with smart contracts on Ethereum. Following this simple guide, you can learn how to use Etherscan too.

Once you have the confidence reading smart contracts, it’s time to start interacting with them. Here we have a guide to teach you how to mint an NFT from the smart contract.

DAOs

So, what the hell is a DAO? Well, by definition it is a ‘Decentralised Autonomous Organisation. In short, its a structure that allows holders to vote and decide on proposals completely autonomously. In web3, NFT and crypto projects use these to decide what happens with treasury money or a shared asset. To learn more, read our guide on what a DAO is. If you’re feeling confident, you can even make your own with our how to create a DAO guide.

Conclusion

We have covered everything you’d need to kick start your Non-fungible journey. However, remember— don’t make any hasty decisions due to FOMO. At the end of the day, NFTs, like crypto, are volatile assets with considerable market risks. So at the end of a long day, sometimes you might just want to laugh. If so, make sure to check out our ultimate list of NFT Memes too.

All investment/financial opinions expressed by NFTevening.com are not recommendations.

This article is educational material.

As always, make your own research prior to making any kind of investment.