Technological innovation is crucial for success in the crypto sector, where investors carefully assess these advancements to determine their potential.…

Noteworthy News

NFT Evening has covered some of the most important tech events in history. From NFT news, to metaverse, blockchain gaming, AI, and digital fashion, you can find the all of the most important news stories here.

Want something more in-depth? Check out our guide on What an NFT is!

Need some context? Brush up on your jargon with our guide on NFT Terminology.

The Ethereum bull run continues to captivate investors, reinforcing its status with a staggering market capitalisation of approximately $435 billion. Meanwhile,…

The cryptocurrency market continues its wild ride in April 2024, with established players like Solana (SOL) and Cardano (ADA) holding…

Avalanche price struggles to break the $50 barrier, signalling uncertain times for its holders. Similarly, ICP crypto makes headway with…

Are you looking to diversify your investment portfolio with cryptocurrencies but need help figuring out where to start in the…

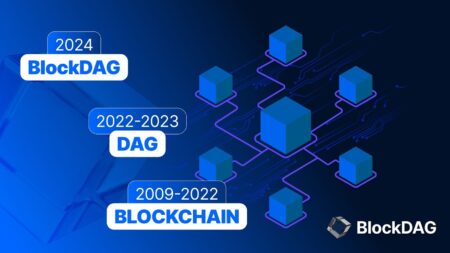

In the crypto world, while analysts review forecasts for Solana and Kaspa, BlockDAG is capturing widespread attention. With its innovative hybrid DAG…

New cryptocurrency Algotech (ALGT) has captured the attention of investors and enthusiasts alike, surpassing even established giants like Solana (SOL) and Ethereum (ETH). As the…

Although there was strong selling pressure on Bitcoin (BTC) last week, it is encouraging that bulls continued to buy at…

The cryptocurrency market is witnessing an unprecedented revolution with digital assets like Bitcoin making overnight millionaires and reshaping investor portfolios.…

Cryptocurrency investment is shifting focus from traditional stalwarts like Ethereum to newer, high-potential projects like BlockDAG. The appeal of BlockDAG…

Envision converting a modest investment into substantial wealth through one prudent decision, akin to the Solana investor—a stay-at-home mother—who saw…

Savvy investors are watching promising altcoins that could ride the wave of bullish sentiment and position themselves for significant profits…