In a shocking move, users of Solend, a Solana-based borrowing and lending service, on Sunday voted to take over the largest whale account on the network. According to Solend, the whale held “an extremely large margin position”. Reportedly, the unprecedented move came as an effort to avoid liquidation “chaos”. What exactly happened with the whale account and how did Solend take over the account?

What Happened at Solend?

On Sunday, Solend Labs posted a governance proposal to liquidate the largest whale account on the network. The platform claimed that the whale’s “extremely large margin position” was “putting Solend protocol and its users at risk”. Based on the details they shared, the whale held 5.7M SOL (worth about $170 million) at a liquidation price of $22.30.

The user had also used their holdings to borrow $108 million in stablecoins. In short, if the user decided to liquidate their wallet, it could drastically bring down SOL prices.

“If SOL drops to $22.30, the whale’s account becomes liquidatable for up to 20% of their borrows (~$21M),” the proposal read. “It’d be difficult for the market to absorb such an impact since liquidators generally market sell on DEXes. In the worst case, Solend could end up with bad debt. This could cause chaos, putting a strain on the Solana network.”

Furthermore, Solend stated that they have been trying to get in touch with the whale since June 13. However, despite their efforts, they were unable to “get the whale to reduce their risk, or even get in contact with them.”

How Did Solend Take Over the Whale Account?

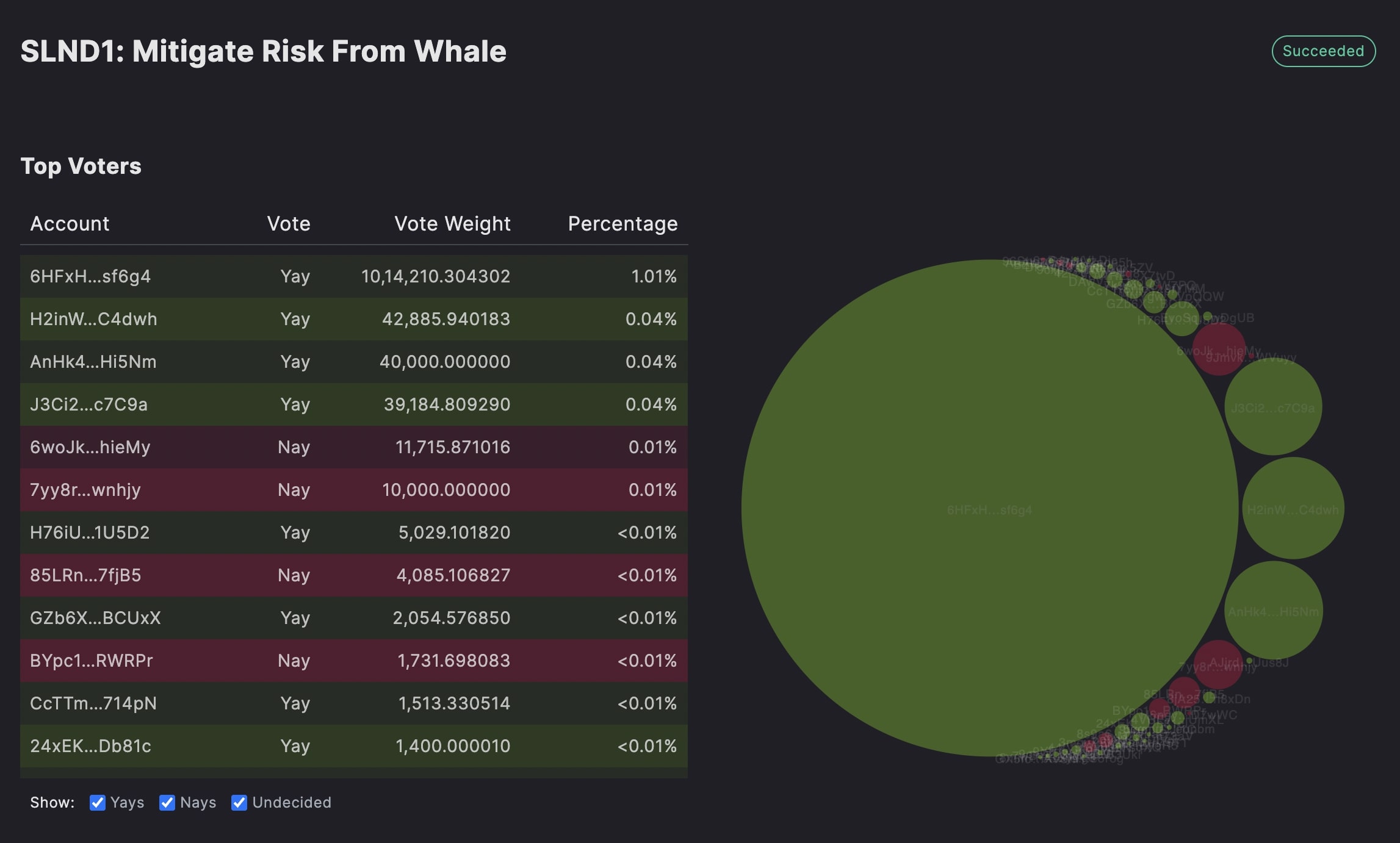

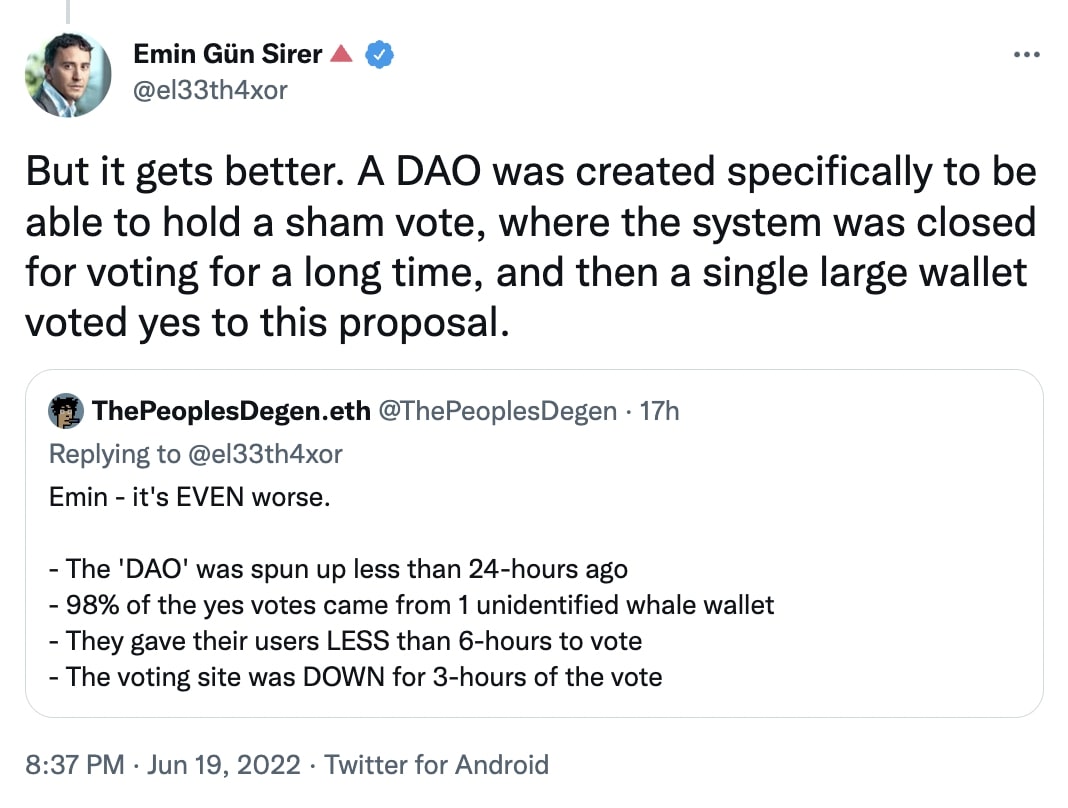

With no response from the whale, Solend took action to “mitigate risk”. Reportedly, they set up a DAO just to hold a vote on the proposal. What’s more, allegedly, the voters only had six hours to vote, during half of which, the voting site was down. They then asked the token holders to vote yes or no for the following:

Vote Yes: Enact special margin requirements for large whales that represent over 20% of borrows and grant emergency power to Solend Labs to temporarily take over the whale’s account so the liquidation can be executed OTC.

Vote No: Do nothing.

What Does This Mean For Decentralisation?

Solend’s unprecedented move to take over a whale account has raised concerns about decentralisation in DeFi. After all, DeFi gains credit for its decentralisation capabilities, wherein they provide financial services without any intermediaries such as banks and brokerages. It is this very feature that is now raising questions.

“A whale’s account is being taken over by other people after a DAO that was spun up 24 hours ago, with a 6 hour timeframe to vote (website was down for 3 hours), voted so,” NFT influencer, Farokh commented.

Meanwhile, Loopify tweeted, “decentralization at it’s finest.”

“Solend labs has set a dangerous precedent of using “emergency powers” to liquidate whale accounts,” Sharat Chandra, vice president of Research and Strategy at EarthID, told Business Today. “Imposition of controls on wallets on the pretext of mitigating liquidity risks is no answer to ensuring the stability of DeFi platforms.”

Clearly, Solend’s action against the whale goes against the very foundation of decentralisation. The move’s wider repercussions remain to be seen.

All investment/financial opinions expressed by NFTevening.com are not recommendations.

This article is educational material.

As always, make your own research prior to making any kind of investment.