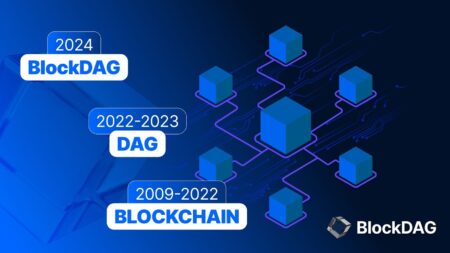

In the crypto world, while analysts review forecasts for Solana and Kaspa, BlockDAG is capturing widespread attention. With its innovative hybrid DAG…

Noteworthy News

NFT Evening has covered some of the most important tech events in history. From NFT news, to metaverse, blockchain gaming, AI, and digital fashion, you can find the all of the most important news stories here.

Want something more in-depth? Check out our guide on What an NFT is!

Need some context? Brush up on your jargon with our guide on NFT Terminology.

New cryptocurrency Algotech (ALGT) has captured the attention of investors and enthusiasts alike, surpassing even established giants like Solana (SOL) and Ethereum (ETH). As the…

Although there was strong selling pressure on Bitcoin (BTC) last week, it is encouraging that bulls continued to buy at…

The cryptocurrency market is witnessing an unprecedented revolution with digital assets like Bitcoin making overnight millionaires and reshaping investor portfolios.…

Cryptocurrency investment is shifting focus from traditional stalwarts like Ethereum to newer, high-potential projects like BlockDAG. The appeal of BlockDAG…

Envision converting a modest investment into substantial wealth through one prudent decision, akin to the Solana investor—a stay-at-home mother—who saw…

Savvy investors are watching promising altcoins that could ride the wave of bullish sentiment and position themselves for significant profits…

The Shift in PayPal Protection Policies The popular online payment platform PayPal has revealed a big change in the policy…

As the crypto realm witnesses a resurgence in XRP Ledger’s functionality and Kaspa’s short-term price predictions, the spotlight now shifts…

BlockDAG has catapulted into the spotlight with a groundbreaking 30,000x ROI projection following the unveiling of its technical whitepaper. This monumental achievement…

In the competitive arena of cryptocurrency presales, two prominent coins have caught the market’s eye: Solana and Dogwifhat. Solana is…

The non-fungible tokens (NFTs) of the Bored Ape Yacht Club (BAYC) had a major decrease in price recently. From its…