On Thursday, one of the nine Alien CryptoPunks was sold for 4,000 ETH, around $12.5 million in a transaction facilitated…

Noteworthy News

NFT Evening has covered some of the most important tech events in history. From NFT news, to metaverse, blockchain gaming, AI, and digital fashion, you can find the all of the most important news stories here.

Want something more in-depth? Check out our guide on What an NFT is!

Need some context? Brush up on your jargon with our guide on NFT Terminology.

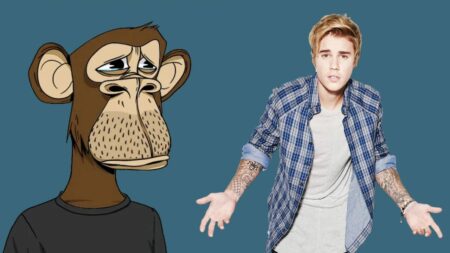

Justin Bieber, the Canadian sensation in the realm of popular music, eagerly explored the domain of Non-Fungible Tokens (NFTs) with…

A seismic shift is underway as Shiba Inu (SHIB) and Avalanche (AVAX) surge, defying conventional market expectations. With price predictions that transcend the norm,…

Amidst a sea of burgeoning ICOs, BlockDAG emerges as the leader with its moon-themed keynote teaser sparking global investor interest. The platform’s…

BlockDAG has set the crypto community abuzz with a new moon-themed keynote teaser, underscoring its lead in the top 10 ICOs…

Although the world of digital assets is dynamic, three contenders, DTX Exchange (DTX), Shiba Inu (SHIB), and Cardano (ADA), have emerged as the focal point of…

The latest report by NonFungible.com highlights a big milestone in the NFT lending world. In the first part of 2024,…

At the Moco Museum, FC Barcelona presents its first two NFTs. Empowerment dedicated to Alexia Putellas and In a Way,…

Moments of anticipation and excitement often represent the potential for groundbreaking shifts in the crypto market. Currently, all eyes are…

The 2024 crypto landscape is vibrant with promising initial coin offerings (ICOs), with each new coin promising to redefine blockchain…

As the cryptocurrency sector demands enhancements in speed and security, various platforms like Algotech and Polygon (MATIC) are advancing with…

Crypto presale events are opportunities in the industry for projects to showcase the strength of their ecosystem and give savvy…