Just like how shoppers gravitate towards discounts, NFT Collectors are always on the lookout for the cheapest gas fees.

Is it possible to plan out your NFT haul and time it when Ethereums gas fees are lowest? The short answer is YES. Gas fees follow the overall market activity, so targeting days and hours when traffic is low would translate to lower gas fees.

Before we proceed, let’s have a short recap. Basically, gas fees represent the amount of computational effort required from miners in order to process and validate a blockchain transaction such as minting an NFT. Ethereum remains to be the biggest and go-to network for NFT and DeFi Projects. Thus, it is notorious for high gas fees, especially during high-profile Drops.

We have a full-length guide about NFT gas fees if you want a thorough discussion.

When are the Ethereum gas fees the lowest?

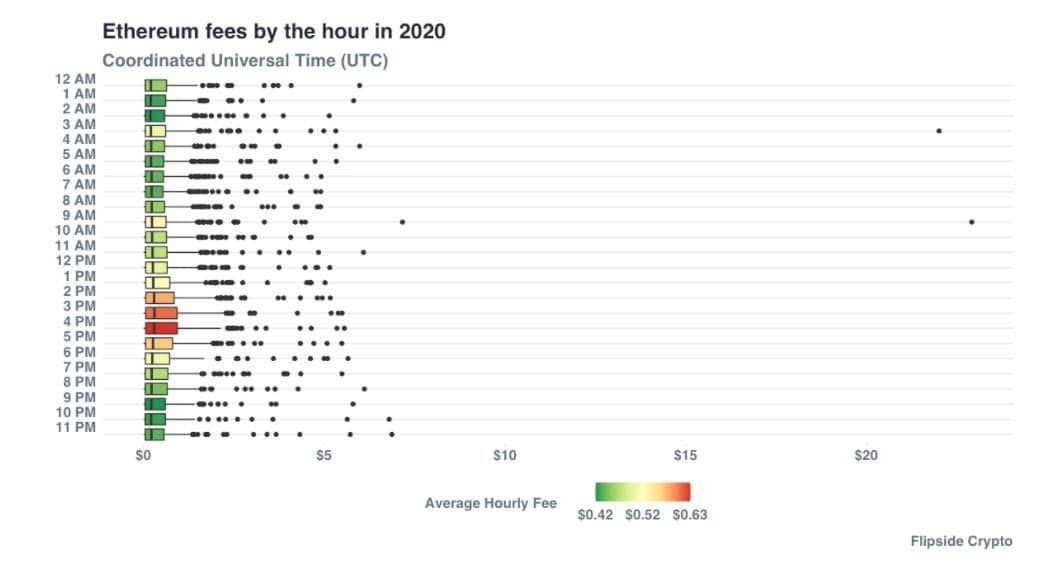

The key to enjoying the cheapest gas fees is identifying certain days and time frames in which the network gets fewer transactions. So the research of Flipside Crypto mapping out Ethereum transactions by the hour provides the insight we need.

According to the chart, the highest transaction fees on Ethereum are between 2 and 6 pm UTC. So avoiding these timeframes automatically allows you to save on gas gees. In parallel, if you want to pay the cheapest Ethereum gas fees, you should perform transactions early in the morning, between 1 and 3 am UTC or late at night, between 9 and 11 pm UTC.

Another consideration is the geographical concentration of the transactions. That is, most transactions are performed in the US, Europe and Asia. Since fewer people work on the weekends, gas fees tend to be lower as well. So another strategy you can employ to avoid the workweek.

Finally, gas fees depend on the ETH price and the level of congestion of the network. Given this, you need to consider the price action of ETH and the overall network activity before transacting.

Any plans to Change this Status Quo?

Admittedly, the strategies above are a bit manual and tedious. So it’s good that Ethereum has a long-term and more concrete strategy to lower network fees.

The Ethereum Foundation is bidding goodbye to the consensus protocol: Proof-of-work (PoW). Ethereum 2.0 will be employing the proof-of-stake (PoS) mechanism. The development is in full swing and the team expects to complete and roll it out by 2022.

This migration will be a game-changer. To illustrate, networks that use PoW like Ethereum approve the most expensive transactions faster than smaller ones resulting in high gas fees. In contrast, PoS is built like a clock. Thus, it records all transactions in real-time, making sure they are processed in order while speeding up the entire network.

Additionally, Ethereum supporters and investors will eventually replace miners because the new version will allow them to stake their tokens.

You can take a look at the price for gas fees on Ethereum by the time of the day. You can also check the gas price in gwei in real-time here.

All investment/financial opinions expressed by NFTevening.com are not recommendations.

This article is educational material.

As always, make your own research prior to making any kind of investment.