In the ever-evolving world of NFTs, the story of Ether stands as a cautionary tale. It illustrates the challenges faced by ambitious projects seeking to carve a niche in the market. What began with tremendous hype and promise eventually led to a series of setbacks.

The NFT space can be cruel to creators, even with the most genuine intent. The downfall caused the project to experience a significant decline in support and trust. This article explores the rise and fall of Ether, shedding light on the factors that contributed to its struggles and the valuable lessons to be learned from its journey.

TL;DR:

- Ether, an anime-themed NFT project, faced challenges with pricing and communication.

- Timing and market competition impacted its launch.

- Lack of transparency and adjustments in strategy contributed to its decline.

The Rise and Fall of Ether: Lessons from an Ambitious NFT Project

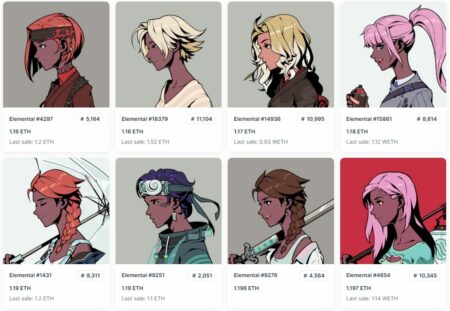

Since inception, Ether positioned itself as an anime-themed project on the Ethereum blockchain. It was poised to be the “Azuki Killer” and, if all went well, it would have actually fulfilled its own prophecy. Ether blends fashion, innovation, and storytelling, and creates an epic, immersive narrative. Initially, the project boasted an impressive collection of 5,555 characters and set out to become one of the first luxury brands utilizing blockchain technology for high-quality clothing and collectibles.

With an ambitious vision and the support of the community, Ether appeared poised for success.

Ether’s early success can be attributed, in part, to the project’s founder, viii, a highly talented digital artist with an established presence in the space. The anticipation surrounding Ether grew exponentially after its Twitter account, @ether, gained prominence. The team implemented a whitelisting campaign, gradually adding those who expressed genuine interest in the project, which further fueled the excitement. However, the project experienced a setback when the mint was delayed until 2023, challenging the initial momentum.

Pricing Strategy and Communication Challenges

Ether’s pricing strategy played a crucial role in shaping its fate. Initially positioning itself as a luxury brand, the project announced a high mint price, hoping to align itself with the perception of exclusivity and quality. However, as market conditions evolved, Ether faced the need to adjust its approach. The team reduced the mint price multiple times, leading to confusion and raising questions about the project’s value proposition.

A lack of effective communication compounded the challenges Ether faced. As the project made pivotal changes to its minting process, supply, and pricing, the community sought clarity on how the funds would be utilized and what benefits minters and holders could expect. Unfortunately, the responses provided were vague, failing to address fundamental concerns about the team’s experience in building a luxury brand and how the project planned to deliver on its promises.

Ether Responds In Haste

Ether faced criticism for its heavily-criticized whitelist mint, which concluded on July 2nd. The drop initially comprised 5,555 NFTs, and 3,678 collectibles remained available for the public mint scheduled for July 9th.

Controversy surrounding the project began prior to the whitelist mint. In the fall of 2022, anonymous founders Viii and CValley, along with software engineer Cygaar, unveiled Ether NFT. However, the announcement that the mint price would be 1 ETH drew criticism, as it was deemed quite high for a new NFT project compared to collections like Invisible Friends, which sold for as low as 0.25 ETH.

In response to the backlash, the Ether NFT team reduced the mint price to 0.65 ETH. Additionally, they set aside 1,750 NFTs for whitelisted users, although specific application rules were not provided. On June 30th, the whitelist mint began with lower-than-expected demand. In a last-minute decision, Ether NFT announced a reduction in the NFT supply from 10,000 to 5,555 collectibles.

Following the conclusion of the whitelist mint, 3,555 NFTs still remained available for public sale, priced at a fixed rate of 0.65 ETH per digital asset. The NFTs sold through the whitelist mint have a floor price of 0.6488 ETH on OpenSea.

Ether NFT Finally Sells Out

Ether finally sold out via a Fair Dutch Auction on July 12th. The auction ended with a sell out price of 0.3 ETH, significantly lower than expected. On the same day, Ether NFT made several decisions to address the concerns and changes in their mint structure.

They announced that they would airdrop 1 Free Ether Capsule for every 1 Ether Capsule held to compensate current holders who did not participate in the new mint pricing. A snapshot had already been taken for this airdrop, and any Ether Capsules purchased after the announcement would not be eligible for the airdrop. The airdrop would include whitelist minters, secondary market participants, and public sale minters. The airdrops were scheduled to be sent on July 12 at 7:30 am PST, and the manual reveal would be available on the official Ether website at 8 am PST on the same day.

To offset the impact of the funding change resulting from the mint structure adjustment, Ether NFT decided to increase the royalties from 5% to 7.5%. They acknowledged the implications of these decisions for holders but emphasized the necessity of adapting to ensure adequate funding for Ether NFT’s “long-term vision”.

Too Little, Too Late?

These decisions had split reviews from the NFT community. While some saw these moves as a way to balance and offset Ether’s losses, the other half still believe these are desperate moves from a rugging team.

On July 14, Ether NFT announced that they would be reducing the secondary royalties on both of their collections. The royalties were decreased (again) from 7.5% to 3.5%. Ether NFT emphasized their commitment to prioritizing community feedback. They encouraged open dialogue within their community and acknowledged the significant role that feedback has played in shaping their project.

Additionally, Ether NFT revealed their plans to host a Holder’s Ask-Me-Anything (AMA) session in the coming weeks. This AMA session would provide an opportunity for holders to learn more about the future of the Ether NFT project.

So, What Happened with Ether? Was it Bad Timing? Botched Mint? Market Sentiment? Or All of these at Once…

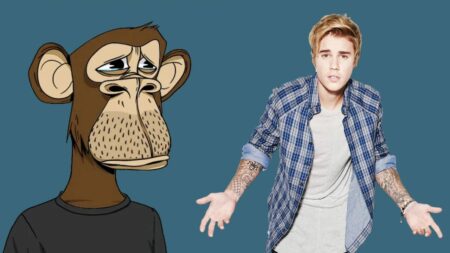

Timing is often a critical factor in the success of any NFT project, and Ether was unfortunate in this regard. The launch coincided with the drop of another hyped Anime PFP project – Azuki Elementals. Though the Elementals bombed and practically almost destroyed NFTs. This whole series of events extracted a significant amount of liquidity from the market and generated bearish sentiment. The low liquidity and unfavorable market conditions dampened Ether’s potential and further compounded its challenges.

The story of Ether reflects a pivotal moment in the NFT space. One where investors and participants increasingly demand transparency, utility, and value from projects. The days of speculative investments based solely on hype and buzzwords are done for. Instead, the market seeks projects with clear plans, experienced teams, and well-defined use cases. Ether’s struggle serves as a reminder that successful projects require contingency plans, effective communication, and an understanding of market dynamics.

While Ether managed to raise a considerable amount of funds through its mint, the project’s journey highlights the difficulties faced by NFT projects aiming to establish themselves as luxury brands. The rise and fall of Ether emphasize the importance of adaptability, transparency, and community engagement. Moving forward, the NFT market is likely to favor projects that demonstrate substance, deliver on promises, and prioritize the needs of their investors. The lessons learned from Ether undoubtedly shapes the future of NFTs. It also paves the way for a more mature and sustainable industry. Or so, we hope!

All investment/financial opinions expressed by NFTevening.com are not recommendations.

This article is educational material.

As always, make your own research prior to making any kind of investment.