This year, we witnessed the meteoric rise of blockchain games across the globe. Fuelled by the wider adoption of crypto and the growing popularity of NFTs, blockchain games became the talk of the town! For the uninitiated, blockchain games are simply any games that use elements of blockchain technology.

One significant reason these games have become a favourite among gamers is that they offer players complete ownership of in-game items. They can transfer these assets to a crypto wallet and even trade them. Additionally, the rise of the play-to-earn movement helped take blockchain games mainstream. According to a report by DappRadar, 754,000 Unique Active Wallets (UAW) were connected to game dApps in Q3 2021 alone!

Five best blockchain games to play today

As the blockchain game sector continues to grow in leaps and bounds, let’s take a look at some of the best blockchain games you can play.

Axie Infinity

Axie Infinity, undoubtedly, has been instrumental in driving the growth of play-to-earn games, as well as NFTs, globally. It scripted history as the first NFT game to cross $1 billion in sales. Moreover, as per the DappRadar report, the game raked in $2.08 billion in Q3 and has now crossed $3.7 billion (at the time of writing)! Developed by Vietnamese startup, Sky Mavis, the Pokémon-inspired game is the biggest play-to-earn game in the industry.

In this battle game, players can collect digital pets called Axies to battle other players and earn tokens. Moreover, each Axie is an NFT that players can buy, trade, and even breed. These digital creatures come with varying stats and rarities, with the rarest of the lost fetching millions of dollars.

Additionally, Axie Infinity offers two in-game tokens: Smooth Love Potions (SLPs) and Axie Infinity Shards (AXS). While the former can be earned by playing the game, the latter is a governance token that gives players the power to vote on key decisions in the game. With Meta’s metaverse move, the value of these tokens has also shot up. AXS’ value, for instance, has skyrocketed 17841.3% this year!

Thetan Arena

Recently launched esport game, Thetan Arena, has been receiving good reviews from the gaming community. The MOBA or Multiplayer Online Battle Arena game is based on the BSC blockchain. Here, players can gather their friends, team up, and battle others. It offers different gameplay modes, including Battle Royale, Superstar, and Deathmatch. It’s simple, fun, compatible with a range of devices, and has attractive graphics. Furthermore, it currently boasts over 5.7 million players!

The blockchain game revolves around characters called “Heroes” that come in three different classes: Assassin, Marksman, and Tank. When players register in the game, they will be assigned a particular Hero. Like Axie Infinity, Thetan Arena too has a dual token economy. While players can earn Thetan Coins (THC) by participating in virtual battles, Thetan Gem (THG) is the game’s governance token. THC can be used to buy NFTs in the game, staking, and more.

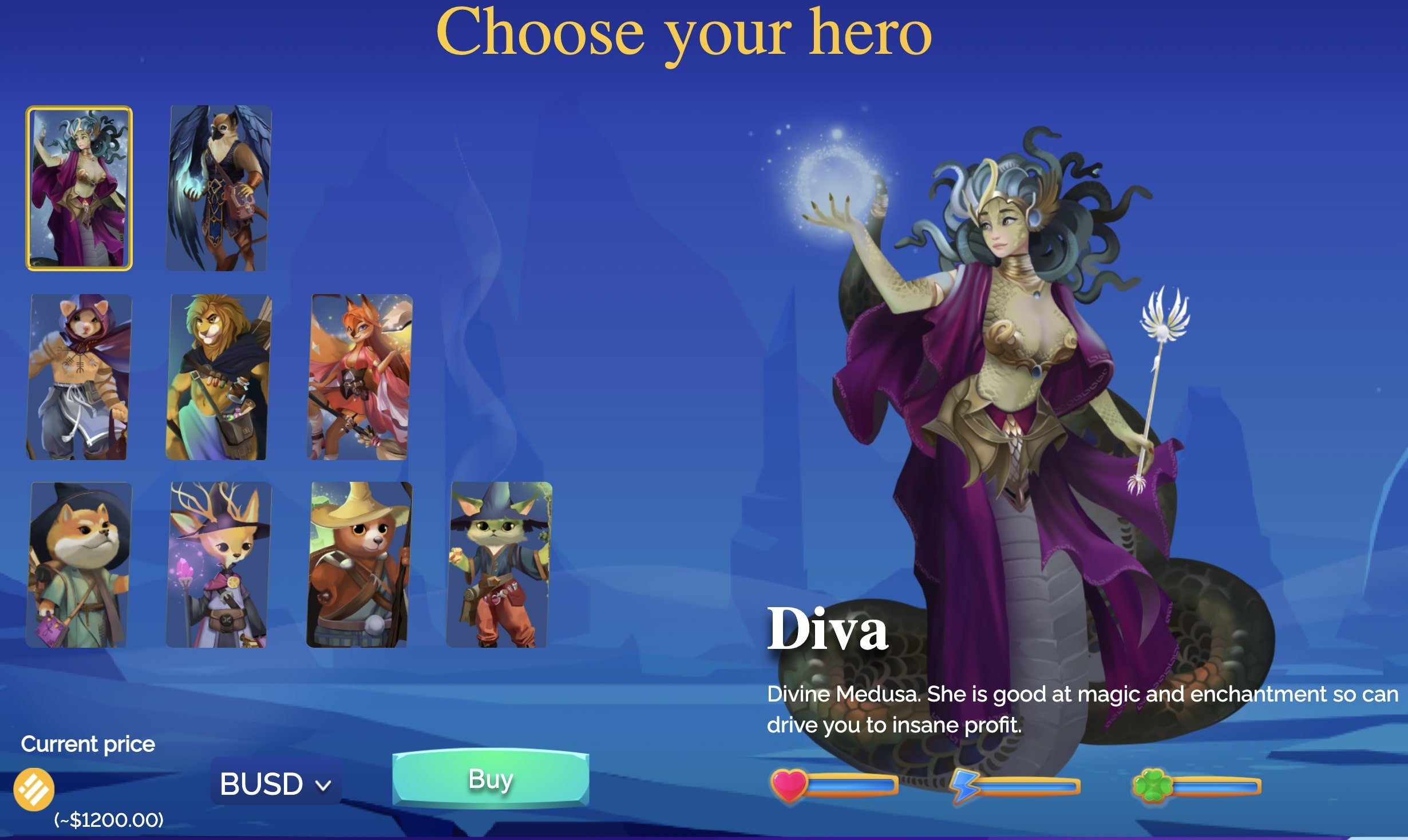

Wizardium

Wizardium is another popular play-to-earn game on the BSC blockchain. True to its name, the game offers a gaming NFT metaverse where “magic comes true”. To play the game, users must own at least one unique Hero/Alchemist NFT. They can then send the alchemist to Wizardium to find valuable elements. Once found, these elements can be dropped in the magic cauldron to brew $WIZZY, the game’s native token. Players can either stake the token to earn more $WIZZY or exchange it for fiat on DEXes.

The Heroes come in three grades: Low, Medium, and High. The higher the grade, the higher the profits the player will earn. Nine different Heroes are available for purchase on the game’s website. Currently, these cost between $250 to $1,200.

Splinterlands

No blockchain games list is complete without Splinterlands. In terms of total players, Splinterlands is just below Axie Infinity with over 664,000 users (Axie has 831,000). It was also one of the most played games in Q3 2021, attracting over 245,000 daily UAW in September, as per DappRadar’s report. The simple and easy to play game is based on the Steem blockchain.

Splinterlands is a collectible trading card multiplayer game. The graphics is reminiscent of Pokémon card games and World of Warcraft characters. All the cards in the game are NFTs and players can purchase these from the in-game shop or the marketplace. As with other games, these cards come in four rarities (Common, Rare, Epic, and Legendary) and seven stats and elements each. Once they buy the cards, players can either battle others, trade the cards, or participate in tournaments. Players can also combine the cards to level up!

Winners of Tournaments, Ranked play, and Quests also win rewards such as collectible cards, card packs, magic potions, and Dark Energy Crystals (the in-game currency). So far, the game has distributed over $4.7 million in tournament prize rewards.

EpicHero

EpicHero is a 3D NFT War Game on the BSC blockchain. More importantly, it’s the first game to reward its NFT holders with 5% of the BNB from token transactions and NFT marketplace transaction taxes. The longer a player holds an EpicHero 3D NFT, the bigger will be the rewards they get. This way, players can easily earn a passive income.

In EpicHero, players can collect and build characters based on heroes from Greek, Norse, China, Japan, Egypt, India, and Roman Mythology. Using the Epic Hero Battle Card NFTs, players can then battle others in the arena. Besides, users can view the 3D NFTs in a 360-degree view.

When it comes to blockchain games, the sky is the limit! You can also check out popular metaverse games like Alien Worlds and The Sandbox. CryptoBlades, Idle Mystic, and Gods Unchained are also some great games you can try.

Learn More About the Top Blockchain Games:

- The Sandbox Metaverse: The Ultimate Guide From $SAND to LAND

- Decentraland: The Ultimate Metaverse Guide

- The Otherside Game: Everything About The BAYC Metaverse

- Axie Infinity: The Biggest Play To Earn Game

- STEPN Explained: Work Out and Make Money!

- Sorare: Soccer Meets Crypto With This Star-Studded Game

- 5 Best AR Games In 2022

- What Is Binemon And Could It Be The Next P2E Success Story?

- Everything In NFT Worlds’ Second Roadmap: What You Need To Know

- The Ultimate Guide To Wolf Game NFTs, Gameplay and WOOL

- What Is Zed Run? Everything About Digital Horseracing

- Best 2 Player Games Unblocked in 2022

- Blankos Block Party Game Guide: Everything You Should Know

All investment/financial opinions expressed by NFTevening.com are not recommendations.

This article is educational material.

As always, make your own research prior to making any kind of investment.